Table of Contents

Insurance fraud is a significant and ever-evolving challenge for IT organizations.

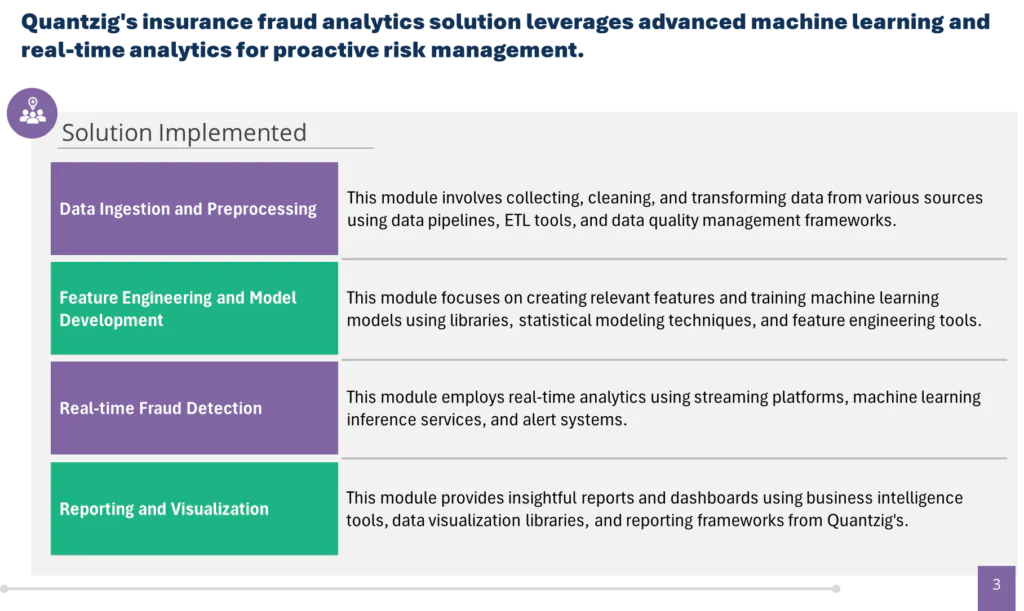

Insurance fraud is a growing concern for IT organizations, presenting a complex and evolving challenge. Sophisticated fraud techniques are emerging, rendering traditional detection methods less reliable. The sheer volume of insurance claims generates an overwhelming amount of data, making manual analysis impractical and time-consuming. Real-time insights are essential to proactively identify and prevent fraudulent activities, minimizing financial losses. However, budget constraints and resource limitations often hinder the implementation of comprehensive fraud detection solutions. This confluence of factors necessitates innovative approaches to address the escalating threat of insurance fraud.

Book a demo to experience the meaningful insights we derive from data through our analytical tools and platform capabilities. Schedule a demo today!

Request a Free DemoQuantzig’s Expertise in Insurance Fraud Analytics Framework for a US-Based Insurance Brand

The IT provider recognized the need for a data-driven approach to fraud detection.

Overview

A leading IT solutions provider was facing significant challenges in effectively detecting insurance fraud. With a growing customer base and increasing complexity in insurance claims, traditional methods were proving insufficient. The company needed a robust and scalable fraud analytics solution to accurately identify fraudulent claims to mitigate financial losses and ensure fair practices.

Problem Statement

- Challenge 1: Traditional fraud detection methods heavily relied on manual review, making them time-consuming and prone to human error.

- Challenge 2: Lack of real-time insights in traditional systems hindered proactive risk management and timely fraud detection.

- Challenge 3: The rapid growth of insurance claims overwhelmed existing systems, leading to delays and inaccuracies in processing and analysis.

- Challenge 4 Evolving fraud tactics required advanced analytical techniques to identify intricate patterns and relationships.

Also Read: How can Insurance Marketing Analytics help you to develop a predictive model?

Get started with your complimentary trial today and delve into our platform without any obligations. Explore our wide range of customized, consumption driven analytical solutions services built across the analytical maturity levels.

Start your Free Trial TodayHow Does Insurance Fraud Occur Across Different Insurance Products?

Quantzig’s insurance fraud analytics solution empowers IT organizations with data-driven insights and advanced analytics to combat fraud and optimize risk management.

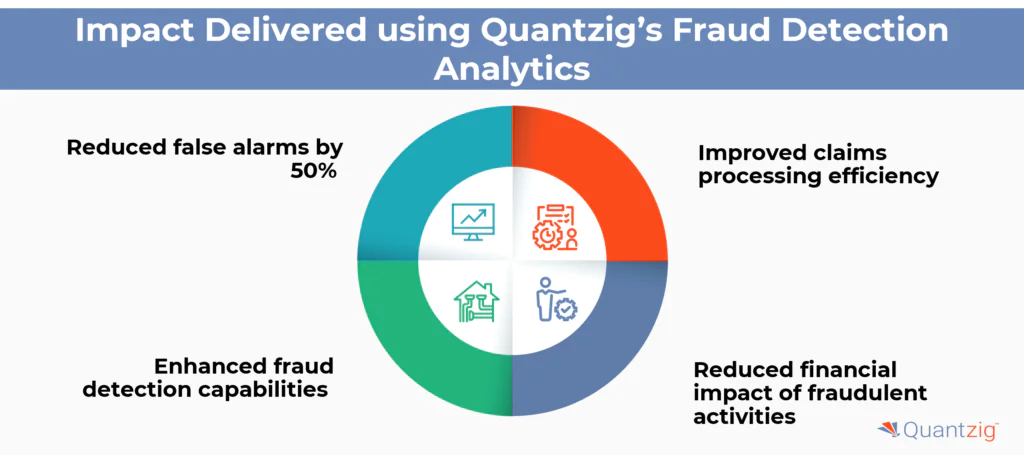

- Improved Fraud Detection Accuracy: The solution utilizes sophisticated machine learning algorithms to identify complex fraud patterns with higher accuracy than traditional methods.

- Reduced False Positives: The solution minimizes false positives by employing advanced algorithms and incorporating feedback loops for continuous model refinement.

- Real-time Insights: The solution provides real-time alerts and insights, enabling proactive risk mitigation and reducing financial losses.

- Scalability and Flexibility: The solution is designed to handle large volumes of data and can be easily scaled to accommodate future growth.

Also Read: Sentiment Analysis: Understanding Insurance Customer Perceptions

Experience the advantages firsthand by testing a customized complimentary pilot designed to address your specific requirements. Pilot studies are non-committal in nature.

Request a Free PilotConclusion

In conclusion, analytics plays a vital role in fighting insurance fraud by providing insurers with the tools and insights necessary to detect and prevent fraudulent activities. By leveraging advanced analytics techniques, such as machine learning and predictive modeling, insurers can identify patterns and anomalies in large datasets, detect suspicious claims, and proactively prevent fraudulent activities. Analytics also enables insurers to improve claims processing efficiency, reduce false alarms, and enhance overall security. By embracing analytics, insurers can stay ahead of fraudsters, protect their financial interests, and maintain customer trust.