Highlights of the Case Study:

| Particulars | Description |

| Client | A major Australian bank with Quantzig to provide more optimized and efficient servicing with branch and ATM cash management at a reduced cost. |

| Business Challenge | An Australian bank was facing the constant problem of boosting productivity, staying ahead of the curve, and improving service delivery across its network of ATMs and branches while also reducing costs. |

| Impact | Quantzig’s supply chain analytics solution allowed the client to introduce a just-in-time (JIT) variable scheduling service to most of the bank’s ATMs. The client could achieve a reduction in ATM servicing costs. |

Table of Contents

Game-Changing Solutions for the Banking Industry

The requirement for precise forecasting of cash demand in automated teller machines (ATMs) is the same as it is in other vending machines. The main difference is that currency must be supplied after a predetermined time. A significant amount of costs result from inaccurate forecasts. When there is a high forecast and a high amount of unused cash stored in the ATM, the bank is charged fees. The bank covers various refilling expenses depending on its agreement with the money delivery operator. Typically, banks pay a sizeable sum in set fees for the refilling and additional fees for the shipment with security arrangements. Some banks may keep 40% more cash in ATMs than is needed, and banks may have thousands of ATMs located all over the country. Therefore, a slight improvement in business operations would result in increased profits.

However, by utilizing Quantzig’s supply chain analytics-driven optimization, lenders may efficiently manage their logistics operations. Quantzig’s technology can determine the suitable method to track the usage pattern with the help of cutting-edge machine learning algorithms, and frequent reloading of ATMs would lower freezing and insurance costs.

Book a demo to experience the meaningful insights we derive from data through our analytical tools and platform capabilities. Schedule a demo today!

Book a demoHow Do Retail Banking Solutions Work?

- Customer-Centric Product Offerings: Retail banking revolves around providing a range of financial products and services tailored to individual consumers and businesses. This includes checking accounts, savings accounts, certificates of deposit (CDs), loans, credit products, and investment options. These offerings cater to diverse needs, preferences, and financial goals of customers, whether they are individual consumers or corporate entities.

- Accessible Banking Channels: In today’s digital age, retail banks operate through various channels to ensure accessibility and convenience for customers. This includes internet platforms, smartphone apps, ATMs, and physical branch locations. These channels allow customers to perform transactions, manage accounts, access financial information, and seek assistance seamlessly, enhancing their overall banking experience.

- Compliance and Regulatory Standards: Retail banking operates within a highly regulated environment governed by institutions such as the Federal Deposit Insurance Corporation (FDIC), Financial Industry Regulatory Authority (FINRA), and other industry bodies. Banks adhere to strict compliance standards to ensure the safety, security, and integrity of customer funds and financial transactions, maintaining trust and confidence in the banking system.

- Personalized Financial Advisory Services: Retail banks often offer personalized financial advisory services to assist customers in achieving their financial goals. This may include retirement planning, investment guidance, and risk management strategies. Certified professionals such as Certified Financial Planners (CFPs) provide expert advice tailored to individual circumstances, helping customers make informed decisions about their finances.

- Risk Management and Financial Stability: Retail banking institutions actively manage risks associated with their operations, including credit risk, market risk, and operational risk. They employ robust risk management frameworks and employ measures such as reserve requirements, margin of interest, and stringent underwriting standards to mitigate risks and maintain financial stability. Additionally, banks offer insurance products, such as automobile financing and trade finance, to protect customers against unforeseen events and losses.

How a Retail Bank Generates Income?

- Interest and Fee-Based Revenue Streams: These banks generate a significant portion of their income through interest and fees charged on various financial products and services. This includes interest earned on loans, credit products, mortgages, and certificates of deposit (CDs), as well as fees for account maintenance, overdrafts, wire transfers, and other banking services. These revenue streams contribute to the bank’s net interest income and fee-based income, bolstering its overall profitability.

- Investment and Asset Management Services: Retail banking solutions offer investment and asset management services to individual consumers and businesses, generating income through management fees, brokerage commissions, and performance-based incentives. Through asset management divisions, banks oversee clients’ investment portfolios, providing advisory services, portfolio diversification, and investment strategies tailored to their financial objectives. Additionally, banks may offer proprietary investment products, mutual funds, and retirement planning services, further expanding their income streams.

- Corporate and Commercial Banking Activities: These banks engage in corporate and commercial banking activities, catering to the financial needs of small, medium, and large enterprises. Income is generated through interest earned on commercial loans, lines of credit, and corporate bonds, as well as fees for treasury and cash management services, trade finance, equipment lending, and commercial real estate financing. By serving corporate clients and facilitating their financial operations, banks capitalize on revenue opportunities while fostering long-term relationships with businesses.

- Foreign Exchange and Remittance Services: These banks facilitate foreign exchange transactions and remittance services for individual customers and businesses engaged in international trade and commerce. Income is derived from currency exchange spreads, transaction fees, and service charges associated with cross-border payments, remittances, and foreign currency transactions. Banks leverage their global network and expertise in foreign exchange markets to generate income while providing convenient and efficient solutions for clients conducting international transactions.

- Diversified Revenue Streams and Cross-Selling Opportunities: Retail banks capitalize on cross-selling opportunities by promoting a diverse range of financial products and services to customers. By cross-selling banking products such as checking accounts, savings accounts, loans, and credit cards, banks can maximize customer relationships and enhance revenue streams. Additionally, banks may offer insurance products, wealth management services, and specialized financial solutions, further diversifying their income sources and strengthening their competitive position in the market. Through strategic marketing initiatives and personalized advisory services, banks leverage cross-selling to generate incremental income while delivering value to customers.

Features of Retail Banking Solutions:

- Diverse Range of Financial Products and Services: Retail banking offers a comprehensive suite of financial products and services tailored to meet the needs of individual consumers and businesses. This includes checking accounts, savings accounts, certificates of deposit (CDs), loans, credit products, investment options, and insurance products. By providing a diverse range of offerings, retail banks cater to various financial goals and preferences, ensuring accessibility and convenience for customers.

- Multi-Channel Accessibility: These banks leverage multiple channels, including internet platforms, smartphone apps, ATMs, and physical branch locations, to enhance accessibility and convenience for customers. Through these channels, customers can perform transactions, manage accounts, access financial information, and seek assistance seamlessly. Multi-channel accessibility ensures that customers can engage with their banking services anytime, anywhere, using their preferred communication and interaction channels.

- Personalized Customer Service: Retail banks prioritize personalized customer service to build lasting relationships with individual consumers and businesses. By understanding customers’ unique financial needs, preferences, and goals, banks offer tailored solutions and advisory services. Whether it’s retirement planning, investment guidance, or loan assistance, banks employ certified professionals such as Certified Financial Planners (CFPs) to provide expert advice and support, enhancing the overall customer experience.

- Risk Management and Regulatory Compliance: These banks operate within a highly regulated environment governed by institutions such as the Federal Deposit Insurance Corporation (FDIC) and the Financial Industry Regulatory Authority (FINRA). Banks adhere to strict compliance standards and risk management protocols to ensure the safety, security, and integrity of customer funds and financial transactions. By implementing robust risk management frameworks and regulatory compliance measures, banks mitigate risks and maintain trust and confidence in the banking system.

- Focus on Financial Inclusion and Community Engagement: These banks play a vital role in promoting financial inclusion and community engagement by serving diverse customer segments, including individual consumers, small businesses, and local communities. Banks offer tailored products and services to meet the unique needs of underserved populations, foster economic development, and support community initiatives. Through initiatives such as financial literacy programs, affordable banking solutions, and community outreach efforts, retail banks demonstrate their commitment to social responsibility and sustainable growth.

Retail Banks vs. Other Types of Banks:

- Customer Focus and Target Market: Retail banks primarily cater to individual consumers and small to medium-sized businesses, offering a wide range of consumer banking and financial services such as checking accounts, savings accounts, and personal loans. In contrast, other types of banks, such as corporate or investment banks, focus on serving large corporations, institutional clients, and high-net-worth individuals, providing specialized financial services tailored to their unique needs and requirements.

- Product and Service Offerings: These banks emphasize consumer-oriented products and services, including basic banking accounts, loans, mortgages, and investment options suitable for individual customers and small businesses. These banks typically prioritize accessibility, convenience, and affordability in their offerings to appeal to a broad customer base. Conversely, other types of banks may specialize in complex financial products and services such as corporate finance, securities underwriting, mergers and acquisitions, and asset management, tailored for sophisticated investors and corporate clients.

- Risk Profiles and Regulatory Oversight: Retail banks typically operate with lower risk profiles compared to other types of banks, focusing on traditional banking activities and serving retail customers within regulated frameworks. They are subject to regulatory oversight by institutions like the Federal Deposit Insurance Corporation (FDIC) and the Financial Industry Regulatory Authority (FINRA) to ensure the safety and soundness of their operations. In contrast, other types of banks, particularly investment banks, may engage in higher-risk activities such as trading, underwriting, and investment management, subject to distinct regulatory requirements and oversight mechanisms.

- Revenue Generation Models: These banks primarily generate income through interest earned on loans, fees from banking services, and investment returns on customer deposits. They rely on a broad customer base and steady deposit flows to sustain their revenue streams. Conversely, other types of banks may generate income through transaction fees, advisory services, underwriting fees, and trading activities, leveraging their expertise in capital markets, investment banking, and corporate finance to drive profitability.

- Market Positioning and Competitive Landscape: These banks operate in a highly competitive market environment, competing for market share based on factors such as interest rates, customer service, and product innovation. They often differentiate themselves through branding, customer experience, and digital banking capabilities to attract and retain customers. In contrast, other types of banks compete in niche markets, focusing on specialized services and client relationships within specific industry sectors or market segments, positioning themselves as trusted advisors and strategic partners to their target clientele.

The Challenges of the Client

A major Australian bank partnered with Quantzig to provide more optimized and efficient servicing with branch and ATM cash management at a reduced cost. The bank faced the constant problem of boosting productivity, staying ahead of the curve, and improving service delivery across its ATMs and branches while lowering costs. Using projections, the client enhanced their cash distribution plans from vaults to branches and ATMs.

The client approached Quantzig for supply chain analytics solutions to identify and minimize non-earning assets (such as cash dispensers, unnecessary or surplus cash in ATMs, vaults, and teller drawers), optimize cash inventories, and redeploy the excess cash effectively through investments and loans. The client wanted help to manage cash efficiently and track the data that indicates information about money managed up to limits, not down-to usage driven levels, resulting in excess idle cash at various points in the supply chain.

Our client was struggling with the following issues.

- Determining usage of cash at a particular location

- Setting up cash limits

- Controlling the cash ordering process

Quantzig’s Supply Chain Analytics Solution for Banks

Quantzig offered a 3-point approach to the client based on the problem statement –

The first strategy involved vault management. Cash traders used an internal vault system to predict the amount of cash at each depot. The vault management system (VMS), used to manage the physical packing, transportation, and cash processing, was tightly connected with the vault system. By giving analysts access to estimates up to 20 days in advance, this method allowed traders to be proactive and take the best possible measures to avoid cash shortages and maximize cash holdings.

The handling of ATM and branch cash was the second essential part of the strategy. The Quantzig ATM and branch cash management team aggressively handled the bank’s ATM and branch cash management requirements in a manner similar to how the cash traders actively controlled the bank’s vault requirements.

Quantzig also provided forecasting tools for cash demand, including time-series and regression machine learning models. Analysts worked on the demand for a single ATM to create a model for the available data set.

Experience the advantages firsthand by testing a customized complimentary pilot designed to address your specific requirements. Pilot studies are non-committal in nature.

Request a Free PilotImpact Analysis of Quantzig’s Supply Chain Analytics in Banking

Quantzig’s supply chain analytics solution allowed the client to introduce a just-in-time (JIT) variable scheduling service to most of the bank’s ATMs. The client achieved a reduction in ATM servicing cost savings. Moreover, the client could minimize excess cash and maximize profits after focusing on cash management and implementing straightforward solutions. The client made cash limits dynamic and set them based on monthly or weekly cash usage trends and minimized daily cash inventory.

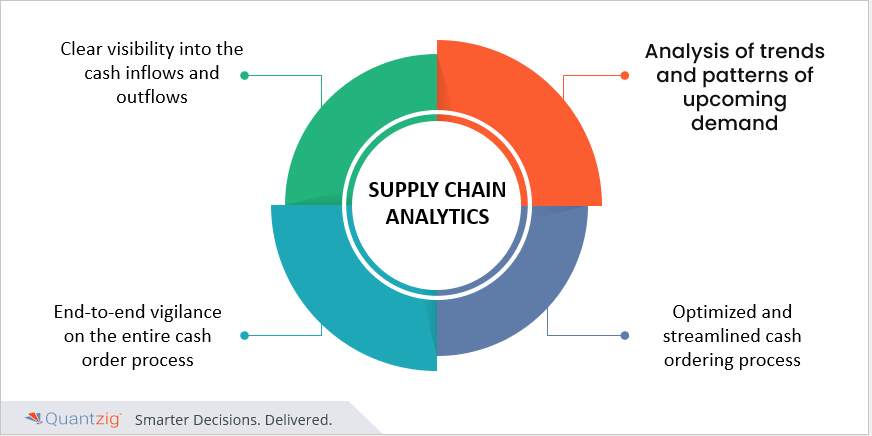

Our solutions unlocked the following benefits for the client.

- Dissected the cash flow data to indicate the net inflow or outflow of cash

- Analyzed daily trends and demands on special local events such as national holidays or any county fair

- Managed, tracked, and reported the entire cash order process

- Streamlined and optimized cash ordering process

Key Outcomes

Optimizing service delivery across ATMs and branch networks requires an integrated cash management software to manage bank branch orders, cash holding, and clearances and to forecast the ATM cash requirements for the bank’s ATM network. Quantzig’s vault management system and forecasting techniques by leveraging the time series analysis and regression modeling provided estimates of the demand, allowing traders to plan cash holdings accordingly. In this way, the client could maximize profits, optimize cash storage, and implement straightforward solutions.

Broad Perspective on Supply Chain Analytics in the BFSI Sector

The branch and ATM networks use an integrated cash requirement forecasting and inventory optimization model to streamline the bank’s cash supply chain. The adopted model aims to reduce the idle cash levels at both branches and ATMs without lowering the customer service level (CSL) by dispensing the correct quantity of cash at the right time and place. ATMs and branches are both subjected to the integrated model at once. The findings showed that the integrated model significantly reduced the amounts of idle cash at ATMs and branch locations while maintaining cash availability and, consequently, customer happiness.

Key Takeaways

Quantzig supply chain analytics solutions provided the following benefits to our Australian retail banking client:

- Clear visibility into the cash inflows and outflows

- Analysis of daily, weekly, and monthly trends and demands patterns on local events such as national and regional holidays or any county fair

- End-to-end vigilance on the entire cash order process

- Optimization and streamlining of the cash ordering process

Get started with your complimentary trial today and delve into our platform without any obligations. Explore our wide range of customized, consumption driven analytical solutions services built across the analytical maturity levels.

Start your Free Trial today