Written By: Sudeshna Ghosh

Table of Contents

Key Takeaways

- Importance of Master Data Management (MDM): Master data management supports key trends such as digital transformation, cloud adoption, AI and ML integration, open banking, and cybersecurity, all of which are crucial for staying competitive and compliant.

- Evolving Data Landscape: The rapid advancements in technology, regulatory demands, and market competition have transformed the data landscape in financial services. Institutions must modernize their data infrastructure and tools to maintain performance and competitiveness, meeting sophisticated regulatory expectations and countering fintech innovations.

- Offensive and Defensive Data Capabilities: Investing in both offensive (e.g., data-driven insights for competitive advantage and personalized customer experiences) and defensive (e.g., regulatory compliance, fraud prevention, and data security) data capabilities is vital. These investments enable institutions to drive growth, enhance customer satisfaction, and protect against emerging risks.

- Quantzig’s Data Management Solutions: Quantzig offers comprehensive data management solutions, including data engineering, strategy consulting, business analytics, data visualization, and process automation.

Introduction to Data Management Trends in Financial Services

The financial services sector is undergoing a significant transformation, driven by technological advancements, changing regulatory requirements, and shifting customer expectations. Financial services institutions, such as banks and insurance companies, rely heavily on transparency in their customer and product master data to capitalize on various industry trends. Master data management (MDM) plays a crucial role in ensuring this transparency, enabling organizations to leverage their existing product and customer master data to address and drive revenues from these trends in the financial services industry.

This blog will explore the key trends in financial services that make MDM essential, the evolving data landscape, the critical role of MDM in financial services, and the benefits of investing in offensive and defensive data capabilities.

Book a demo to experience the meaningful insights we derive from data through our analytical tools and platform capabilities. Schedule a demo today!

Request a Free DemoQuantzig’s Expertise in Data Management Framework for a US-Based Financial Institution

| Category | Details |

|---|---|

| Client Details | A leading financial institution based in the USA with annual revenue of $10bn+. |

| Challenges Faced by The Client | A leading financial institution based in the USA, faced significant challenges in managing its vast and complex data infrastructure. The company struggled with data silos, inconsistent data quality, and inadequate data analytics capabilities. |

| Solutions Offered by Quantzig | Quantzig’s data management solutions helped the Financial Institution overcome these challenges by Data Engineering, Data Strategy Consulting, and Business Analytics Services. |

| Impact Delivered | Improved Data Quality Enhanced Analytics Capabilities Increased Operational Efficiency |

Client Details

A leading financial institution based in the USA with annual revenue of $10bn+.

Challenges in Data Management Faced by the Client

A leading financial institution based in the USA faced significant challenges in managing its vast and complex data infrastructure. The company struggled with data silos, inconsistent data quality, and inadequate data analytics capabilities, hindering its ability to make informed business decisions. This led to inefficiencies in operations, delayed decision-making, and a lack of visibility into key performance indicators.

Data Management Solutions Offered by Quantzig for the Client

Quantzig’s data management solutions helped the client overcome these challenges by:

- Data Engineering: Quantzig streamlined the company’s data infrastructure, integrating disparate systems and ensuring seamless data flow.

- Data Strategy Consulting: Quantzig developed a tailored analytics roadmap, identifying process gaps and introducing plug-and-play business acceleration modules.

- Business Analytics Services: Our team analyzed the company’s data to identify areas of improvement, enhancing performance across the value chain.

Impact Delivered using Quantzig’s Expertise

Quantzig’s data management solutions delivered significant benefits to the client:

- Improved Data Quality: Consistent data quality ensured accurate decision-making and reduced errors.

- Enhanced Analytics Capabilities: Quantzig’s analytics services enabled the company to make data-driven decisions, driving business growth and efficiency.

- Increased Operational Efficiency: Streamlined processes and automated tasks reduced manual intervention, freeing up resources for strategic initiatives.

By partnering with Quantzig, the client was able to transform its data management capabilities, driving business growth, improving operational efficiency, and enhancing decision-making capabilities.

Also Read: Guide to Advanced Marketing Analytics Solutions and Its Business Benefits

Get started with your complimentary trial today and delve into our platform without any obligations. Explore our wide range of customized, consumption driven analytical solutions services built across the analytical maturity levels.

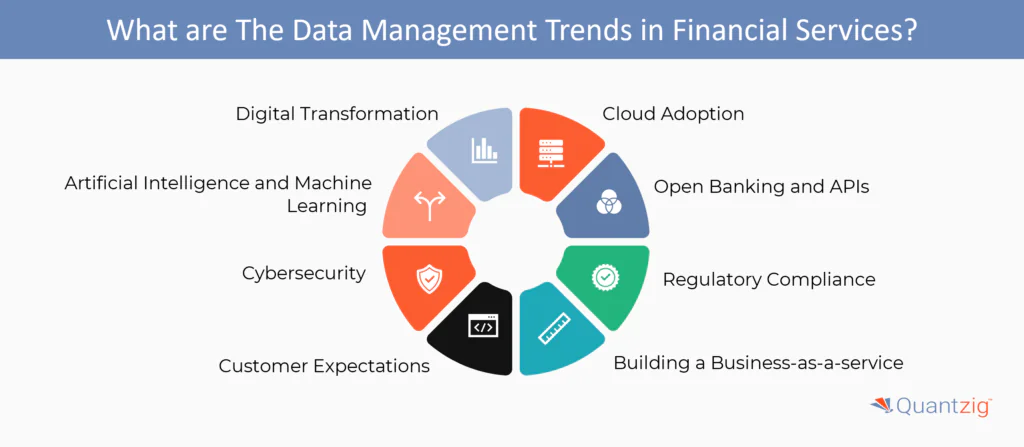

Start your Free Trial TodayWhat are The Data Management Trends in Financial Services?

The financial services landscape is rapidly evolving, driven by the convergence of digital innovation, changing customer behaviors, and intensifying regulatory scrutiny. As a result, financial institutions are increasingly relying on master data management (MDM) to ensure the accuracy, completeness, and consistency of their critical business data. Effective MDM is crucial for maintaining data quality, improving operational efficiency, and enhancing customer experiences. In this context, MDM plays a vital role in supporting key trends in financial services, such as digital transformation, data-driven decision-making, and regulatory compliance.

1. Digital Transformation

The financial services sector is undergoing a digital transformation, with customers increasingly using digital channels to interact with institutions. This shift requires financial institutions to manage their data more effectively, ensuring seamless integration across digital platforms and maintaining data consistency.

2. Cloud Adoption

Cloud computing is becoming increasingly popular in the financial services sector, offering scalability, flexibility, and cost savings. However, this shift also presents data management challenges, such as ensuring data security and compliance in the cloud.

3. Artificial Intelligence and Machine Learning

AI and ML are being used to improve risk management, customer service, and operational efficiency. Effective data management is critical to ensure that these technologies are trained on accurate and reliable data.

4. Open Banking and APIs

Open banking and APIs enable financial institutions to share data with third-party providers, enhancing customer experiences and improving operational efficiency. However, this requires robust data management to ensure data security and compliance.

5. Cybersecurity

Cybersecurity threats are becoming increasingly sophisticated, and financial institutions must ensure that their data is protected from these threats. Effective data management is critical to detecting and responding to cyber threats.

6. Regulatory Compliance

Regulatory requirements are becoming increasingly complex, and financial institutions must ensure that they are compliant with these regulations. Effective data management is critical to ensuring compliance and reducing the risk of fines and reputational damage.

7. Customer Expectations

Customers are increasingly expecting personalized services and seamless experiences across all channels. Effective data management is critical to delivering these experiences, ensuring that customer data is accurate and up-to-date.

8. Building a Business-as-a-service

Financial services organizations are transforming into digital service providers via platforms, effectively encapsulating their business within a digital framework. To achieve this ambition, high-quality data is not only essential but must also be presented in a manner that aligns with contextual business information views rather than technical views.

These trends highlight the importance of effective data management in the financial services sector. Master data management is essential for financial institutions to stay competitive, compliant, and customer-centric.

The Evolving Data Landscape

Over the past few years, the rapid advancements in data and technology have led to heightened regulatory expectations and intensified market competition. The emergence of cutting-edge technologies such as open application programming interfaces (APIs), artificial intelligence (AI), cloud computing, machine learning (ML), and others has significantly transformed the data supply chains of financial institutions. In response, data and technology leaders are compelled to undertake comprehensive modernization initiatives, encompassing the overhaul of tools and infrastructure to ensure optimal performance and competitiveness in this evolving landscape.

As regulators become increasingly sophisticated, and driven by enhanced data literacy and capabilities, they are now demanding more granular, traceable, and frequently collected data in an organized manner. The heightened market competition has led financial institutions to innovate and invest in their data assets to remain competitive. To counter the emergence of fintech entrants, institutions are transforming their traditional business models and value chains by leveraging modern platforms that amplify their data capabilities.

The Critical Role of Master Data Management in Financial Services

The common thread among the top trends in financial services is the reliance on data transparency. Master data management plays a crucial role in achieving this transparency by providing a unified, trusted view of critical business information, encompassing customer and product master data. By defining and implementing robust governance policies, master data management ensures that the origin, accuracy, coherence, accessibility, security, auditability, and ethical considerations of customer and product data are thoroughly managed and aligned with the organization’s business objectives.

- Data Governance: MDM ensures that data governance policies are managed consistently across the organization, reducing data inconsistencies and improving data quality.

- Data Integration: This technique enables the integration of data from various sources, ensuring that data is accurate, complete, and consistent.

- Data Security: This tool ensures that data is secure and protected from unauthorized access, ensuring compliance with regulatory requirements.

- Data Analytics: MDM enables the use of data analytics to improve operational efficiency, reduce risk, and enhance customer experiences.

- Data Quality: It ensures that data is accurate, complete, and consistent, reducing errors and improving decision-making.

- Data Compliance: It ensures that data is compliant with regulatory requirements, reducing the risk of fines and reputational damage.

- Data Sharing: MDM enables the sharing of data with third-party providers, enhancing customer experiences and improving operational efficiency.

MDM plays a critical role in the financial services sector, enabling organizations to manage and govern their data effectively. By ensuring data governance, integration, security, analytics, quality, compliance, and sharing, MDM helps financial institutions stay competitive, compliant, and customer-centric.

Why Invest in Offensive and Defensive Data Capabilities?

Investing in both offensive and defensive data capabilities has become paramount for institutions seeking to thrive and maintain a competitive edge. By strategically developing these capabilities, organizations can harness the power of data to drive innovation, enhance customer experiences, and mitigate risks.

1. Offensive Data Capabilities

- Competitive Advantage: Leveraging data-driven insights allows institutions to identify market opportunities, develop innovative products, and stay ahead of the competition.

- Personalized Customer Experiences: By analyzing customer data, institutions can tailor their offerings, communication, and services to meet individual needs, fostering loyalty and satisfaction.

- Operational Efficiency: Data-driven decision-making can streamline processes, optimize resource allocation, and improve overall operational efficiency, leading to cost savings and increased profitability.

2. Defensive Data Capabilities

- Regulatory Compliance: Robust data management practices ensure adherence to evolving regulatory requirements, mitigating the risk of penalties and reputational damage.

- Fraud Detection and Prevention: Advanced analytics can identify suspicious activities, enabling institutions to proactively detect and prevent fraudulent transactions, safeguarding customer assets and trust.

- Data Security and Privacy: Implementing strong data security measures and adhering to privacy regulations protect sensitive information from breaches, maintaining customer trust and preserving brand reputation.

In conclusion, investing in both offensive and defensive data capabilities is a strategic imperative for financial institutions seeking to thrive in the digital age. By embracing data-driven strategies, organizations can drive growth, enhance customer experiences, and maintain a robust defense against emerging risks and challenges.

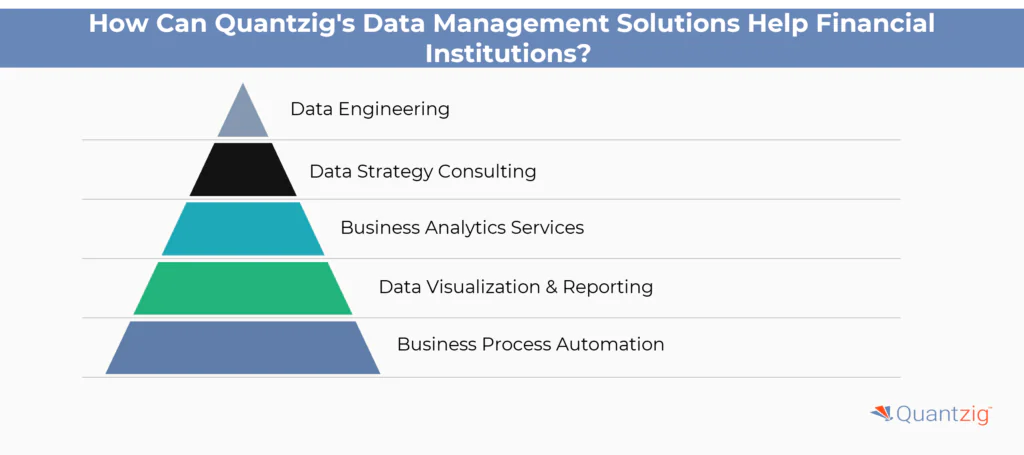

How Can Quantzig’s Data Management Solutions Help Financial Institutions?

Quantzig’s comprehensive data management solutions empower organizations to harness the full potential of their data. Their portfolio includes a range of services designed to streamline data infrastructure, enhance accessibility, and ensure data integrity. Key offerings include:

- Data Engineering: Leveraging state-of-the-art industry frameworks, Quantzig simplifies data stacks, optimizing data flow and ensuring data integrity.

- Data Strategy Consulting: Quantzig crafts tailored analytics roadmaps, identifies process gaps, and introduces plug-and-play business acceleration modules to drive sustainable growth and informed decision-making.

- Business Analytics Services: Quantzig specializes in identifying solutions to complex business problems, enhancing performance across the entire value chain, and driving informed decisions.

- Data Visualization & Reporting: Intuitive, three-click visualizations simplify decision-making, providing actionable insights and driving efficiency across the organization.

- Business Process Automation: Custom apps streamline and automate business processes, reducing manual intervention and unlocking substantial time and cost savings.

By investing in Quantzig’s data management solutions, organizations can unlock the full potential of their data, drive innovation, and maintain a competitive edge in the market.

Also Read: Marketing Data Management: How to Leverage Your Data

Experience the advantages firsthand by testing a customized complimentary pilot designed to address your specific requirements. Pilot studies are non-committal in nature.

Request a Free PilotConclusion

Effective data management is critical for financial institutions to stay competitive, compliant, and customer-centric. Master data management is essential for managing and governing data effectively, and investing in both offensive and defensive data capabilities can provide a competitive advantage, reduce risk, enhance customer experiences, and improve operational efficiency. Quantzig Solutions offers a comprehensive portfolio of data management solutions to help financial institutions achieve these goals.