Table of Contents

What You Can Expect From This Case Study

- Highlights of the Case Study

- Churn Analytics Solutions for the Banking Industry

- Challenges Faced by the Client

- Quantzig’s Churn Analytics Solutions

- Impact Analysis of Quantzig’s Solutions

- Key Outcomes

- Broad Perspective of Churn Analytics in BFSI Sector

- Key-Takeaways of Churn Analytics in Banking

Highlights of the Customer Attrition Analysis Case Study

Highlights of the Case Study:

| Particulars | Description |

| Client | A leading bank operating at a global level was facing a rapid increase in customer churn, leading to a loss in revenue and a rise in CACs. |

| Business Challenge | Our client wanted to leverage its vast repository of customer data to reduce churn, improve the effectiveness of its marketing campaigns, and develop new programs for customer retention. |

| Impact | Qunatzig experts deployed a robust churn analytics in banking model to enable the client to understand customer behavior/preferences better. These insights were used to develop new programs and initiatives to reduce churn rates and improve customer retention. |

Game-Changing Solutions for the Banking Industry

The banking industry is highly volatile, as banks need to compete for business among themselves and other financial institutions. Most banking products are easy to replicate, and hence, it is challenging for banks to retain customers. Banks and financial companies spend significant effort and resources on customer acquisition. However, data analytics has proven that maintaining an existing customer is more economical than acquiring a new one. Therefore, customer retention should be the top priority for the banks.

The Challenges of the Client

Our client is a leading bank operating globally and has made significant investments in gathering and storing customer data. However, it lacked the knowledge and insights to use this valuable data for deriving insights that would lead to practical business applications. Failure to analyze this complex dataset also resulted in a rapid increase in customer churn. This led to a loss in revenue and increased customer acquisition costs.

The client approached Quantzig to leverage its expertise in offering customer churn analysis solutions to devise an extensive data-driven analytics framework, reduce churn, improve the effectiveness of its marketing campaigns, and develop new programs for customer retention. The client also wanted to understand pricing and competition in the banking industry to devise effective ways to retain customers and enhance customer satisfaction levels.

The client attended one of our webinars on customer retention, post which, they decided to connect with our experts to understand what they can achieve with a robust churn analytics model.

Quantzig’s Customer Attrition Analysis Solution for Banks

Qunatzig experts deployed a robust churn analytics model to help the client understand customer behavior/preferences better. In the first phase of the churn analysis, our experts focused on developing predictive customer churn models with the help of the client’s existing churn reports and customer datasets. The second phase of the churn analysis revolved around improving churn metrics and analysis accuracy to deliver valuable insights to the client’s sales and operations team. The third and final phase of the churn analysis focused on leveraging advanced customer analytics solutions to develop a customized dashboard to deliver in-depth insights into customer behavior. We implemented churn prediction modeling to capture both hard churn and soft churn customer data. Also, our experts aimed to develop new programs and initiatives that would help reduce churn rates and improve customer retention rates.

Impact Analysis of Quantzig’s Churn Analytics in Banking

The solution offered by Quantzig helped the client reap greater benefits from a well-segmented and thoroughly analyzed customer database. In addition, our churn analytics solution enabled our client to get a holistic 360-degree view of the customer base and its interactions across multiple channels, such as bank visits, calls to customer service departments, web-based transactions, and mobile banking. Besides these benefits, Quantzig’s solution impacted the client’s business in the following ways:

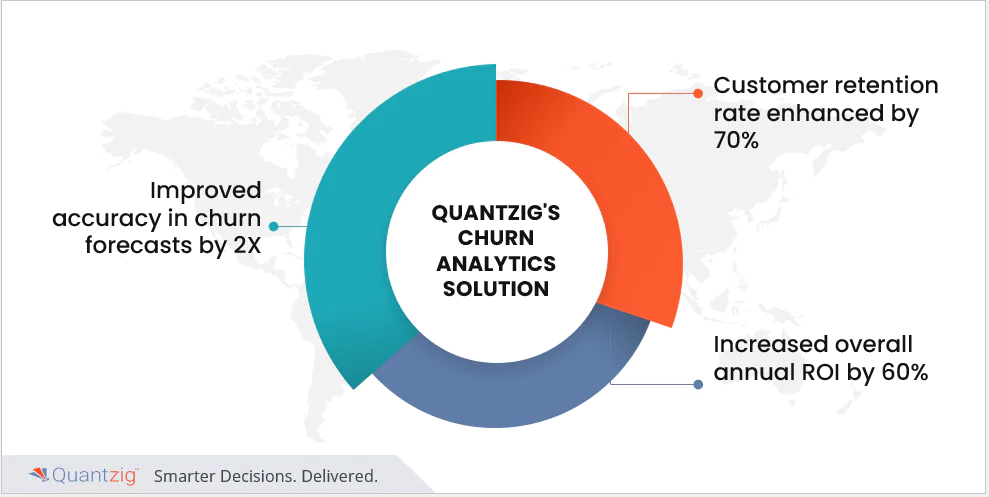

- Improved accuracy in churn forecasts by 2X

- Enhanced customer retention rate by 70%

- Improved overall annual ROI by 60%

- Improved the effectiveness of marketing campaigns

- Created new opportunities for cross-selling and upselling

- Reduced the gap between the bank’s products and customer’s needs

- Enhanced customer loyalty

- Developed a robust customer retention program

- Improved customer satisfaction level

- Increased customer base

Key Outcomes

Quantzig’s churn analytics solution leveraged the client’s expansive database of its customers to derive an in-depth understanding of the customers. This enabled us to help our client cater to the needs of its customers, which led to an improvement in customer retention rate, higher customer satisfaction, and a growing base of satisfied customers. We were able to drive home that it is in our client’s interest to focus more on customer retention rather than customer acquisition. However, customers from all categories are likely to close accounts, and new customers (whose relationship is 60 days or less) close at a 75%-100% rate than those in other categories. Hence, a successful growth strategy needs to be built around customer retention in the highly competitive banking environment.

Broad Perspective on Churn Analytics in the BFSI Sector

Over the last five years, churn analysis has grown significantly in the banking industry due to the rise in the number of customers that switched over to other banking service providers. Acquiring new customers is a more expensive process than retaining old ones. Therefore, banks have started implementing a churn analytics solution to reduce attrition rates and customer acquisition costs. Quantzig’s churn analysis solutions enable its clients to develop strategies to enhance and retain customers, thereby significantly lowering costs associated with onboarding new customers. Quantzig’s churn analysis solutions also effectively track customers’ preferences, reducing the chances of customer attrition and enhancing and bolstering subscriber loyalty.

Key Takeaways of customer attrition analysis in banking:

- Evaluated the client’s customer database to derive insights into customer needs

- Devised a customer retention plan targeted at reducing customer churn

- Reduced the gap between the bank’s products and customer’s needs

- Enhanced customer satisfaction levels, which led to an increase in customer loyalty

- Helped develop an effective marketing plan that addressed customer needs

- Improved customer loyalty, leading to an overall annual ROI of 60%