Author: Associate Vice President, Analytics and Data Strategy, Quantzig.

Table of Contents

Key Takeaways of churn analysis in banking:

- Evaluated the client’s customer database to derive insights into customer needs

- Devised a customer retention plan targeted at reducing customer churn

- Reduced the gap between the bank’s products and customer’s needs

- Enhanced customer satisfaction levels, which led to an increase in customer loyalty

- Helped develop an effective marketing plan that addressed customer needs

- Improved customer loyalty, leading to an overall annual ROI of 60%

Broad Perspective on Churn Analytics in the BFSI Sector

Over the last five years, churn analysis has grown significantly in the banking industry due to the rise in the number of customers that switched over to other banking service providers. Acquiring new customers is a more expensive process than retaining old ones. Therefore, banks have started implementing a churn analytics solution to reduce attrition rates and customer acquisition costs. Quantzig’s churn analysis solutions enable its clients to develop strategies to enhance and retain customers, thereby significantly lowering costs associated with onboarding new customers. Quantzig’s churn analysis solutions also effectively track customers’ preferences, reducing the chances of customer attrition and enhancing and bolstering subscriber loyalty.

How to do Customer churn measurement in banking?

| Aspect | Description |

|---|---|

| Advanced Analytics & Machine Learning | Banks use advanced analytics and machine learning algorithms (e.g., ensemble learning, gradient boosting) to predict customer churn by analyzing data such as transaction history, interactions, and NPS scores. |

| Key Performance Indicators (KPIs) | Banks track KPIs like NPS, customer lifetime value (LTV), and unit margins to understand behavior, satisfaction, and profitability. Monitoring loyalty programs and brand perception adds further insights. |

| Customer Journey Mapping | Mapping customer touchpoints throughout their lifecycle helps identify pain points and potential triggers, allowing banks to tailor marketing, products, and support to improve customer experience and reduce churn. |

| Continuous Monitoring & Optimization | Ongoing evaluation and optimization of churn models using techniques like k-fold cross-validation and resampling ensure accuracy and reliability over time. |

| Business Alignment & Customer Focus | Churn measurement aligns with business goals, focusing on customer satisfaction, loyalty, and retention. This proactive approach optimizes marketing and strengthens customer relationships for growth. |

Game-Changing Solutions for the Banking Industry

The banking industry is highly volatile, as banks need to compete for business among themselves and other financial institutions. Most banking products are easy to replicate, and hence, it is challenging for banks to retain customers. Banks and financial companies spend significant effort and resources on customer acquisition. However, data analytics has proven that maintaining an existing customer is more economical than acquiring a new one. Therefore, customer retention should be the top priority for the banks.

Customer Churn in Banking: A Prevention Strategy

- Implementing Advanced Machine Learning Methods: By harnessing machine learning techniques such as ensemble learning, gradient boosting, and support vector machines, banks can develop sophisticated prediction models. These models utilize historical customer data, NPS scores, and other relevant metrics to identify potential churners accurately. Employing algorithms like XGBoost and Random Forest enables banks to predict churn with high precision, thus allowing proactive intervention strategies.

- Enhancing Customer Experience through Personalization: Leveraging customer journey mapping and data-driven insights from exploratory data analysis, banks can tailor their services and marketing efforts to meet individual customer needs. By understanding the buyer journey and preferences, banks can optimize products, services, and after-sales support, thereby fostering stronger brand perception and customer loyalty.

- Optimizing Loyalty Programs and Credit Limit Extensions: Banks can improve customer retention by optimizing loyalty programs based on lifetime value and unit margins. By offering personalized incentives and rewards, backed by data science-driven insights, banks can enhance the overall customer experience and increase loyalty. Moreover, strategic credit limit extensions, informed by prediction models, can help retain valuable customers by meeting their evolving financial needs.

- Continuous Monitoring and Adaptation: Implementing operational, strategic, and tactical levels of strategies is crucial. This includes regularly analyzing customer churn prediction models, updating them with fresh data, and recalibrating strategies based on changing market dynamics. Employing resample training sets and techniques like k-fold cross-validation ensures the robustness and accuracy of the prediction models over time.

- Fostering a Customer-Centric Culture: Ultimately, preventing customer churn requires a holistic approach that prioritizes customer-centricity across all levels of the organization. This entails fostering a culture that values customer feedback, prioritizes customer satisfaction, and continuously strives to optimize products and services based on customer insights. By embedding customer-centric principles into the organizational DNA, banks can proactively address churn risks and cultivate long-term customer loyalty.

Why Analyzing Customer Churn Prediction is Important?

By leveraging advanced machine learning techniques, banks can not only identify at-risk customers but also implement targeted strategies that enhance retention, improve financial outcomes, and foster loyalty.

Enhanced Customer Retention and Loyalty

Analyzing customer churn empowers banks to identify at-risk customers and implement proactive retention strategies. Using machine learning techniques like XGBoost and ensemble learning, banks can predict churn accurately, preserving relationships, fostering long-term loyalty, and improving overall customer experience.

Optimized Marketing and Resource Allocation

By understanding churn patterns, banks can optimize marketing efforts and allocate resources efficiently. Analyzing prediction models helps identify high-risk segments, enabling tailored campaigns that maximize ROI while minimizing resource wastage.

Improved Financial Performance

Predicting churn positively impacts financial performance by reducing acquisition costs and increasing customer lifetime value. Loyal customers contribute to sustainable revenue growth, making churn analysis crucial for optimizing profitability and long-term success.

Enhanced Brand Perception

Proactive churn management improves brand perception and customer satisfaction. By offering personalized experiences, loyalty programs, and strategic credit extensions, banks build trust and differentiate themselves in a competitive market.

Informed Strategic Decision-Making

Churn analysis provides insights for better decision-making and future planning. By combining prediction models with customer journey mapping and NPS scores, banks can tailor product development and services, aligning with customer preferences to drive retention and growth.

How Quantzig Helped a Global Bank Reduce Customer Churn and Improve Retention?

| Particulars | Description |

| Client | A leading bank operating at a global level was facing a rapid increase in customer churn, leading to a loss in revenue and a rise in CACs. |

| Business Challenge | Our client wanted to leverage its vast repository of customer data to reduce churn, improve the effectiveness of its marketing campaigns, and develop new programs for customer retention. |

| Impact | Quantzig experts deployed a robust churn analytics model to enable the client to understand customer behavior/preferences better. These insights were used to develop new programs and initiatives to reduce churn rates and improve customer retention. |

The Challenges of the Client

Our client is a leading bank operating globally and has made significant investments in gathering and storing customer data. However, it lacked the knowledge and insights to use this valuable data for deriving insights that would lead to practical business applications. Failure to analyze this complex dataset also resulted in a rapid increase in customer churn. This led to a loss in revenue and increased customer acquisition costs.

The client approached Quantzig to leverage its expertise in offering customer churn analysis solutions to devise an extensive data-driven analytics framework, reduce churn, improve the effectiveness of its marketing campaigns, and develop new programs for customer retention. The client also wanted to understand pricing and competition in the banking industry to devise effective ways to retain customers and enhance customer satisfaction levels.

Quantzig’s Churn Analytics Solution for Banks

Qunatzig experts deployed a robust churn analytics model to help the client understand customer behavior/preferences better. In the first phase of the customer churn analysis, our experts focused on developing predictive customer churn models with the help of the client’s existing reports and customer datasets. The second phase revolved around improving metrics and analysis accuracy to deliver valuable insights to the client’s sales and operations team. The third and final phase of the customer churn analysis focused on leveraging advanced customer analytics solutions to develop a customized dashboard to deliver in-depth insights into customer behavior. We implemented prediction modeling to capture both hard and soft churn customer data. Also, our experts aimed to develop new programs and initiatives that would help reduce churn rates and improve customer retention rates.

Book a demo to experience the meaningful insights we derive from data through our analytical tools and platform capabilities. Schedule a demo today!

Book a free demoImpact Analysis of Quantzig’s Churn Analytics in Banking

Quantzig’s churn analytics solution leveraged the client’s expansive database of its customers to derive an in-depth understanding of the customers. This enabled us to help our client cater to the needs of its customers, which led to an improvement in customer retention rate, higher customer satisfaction, and a growing base of satisfied customers. We were able to drive home that it is in our client’s interest to focus more on customer retention rather than customer acquisition. However, customers from all categories are likely to close accounts, and new customers (whose relationship is 60 days or less) close at a 75%-100% rate than those in other categories. Hence, a successful growth strategy needs to be built around customer retention in the highly competitive banking environment.

The solution offered by Quantzig helped the client reap greater benefits from a well-segmented and thoroughly analyzed customer database. In addition, our churn analytics solution enabled our client to get a holistic 360-degree view of the customer base and its interactions across multiple channels, such as bank visits, calls to customer service departments, web-based transactions, and mobile banking. Besides these benefits, Quantzig’s solution impacted the client’s business in the following ways:

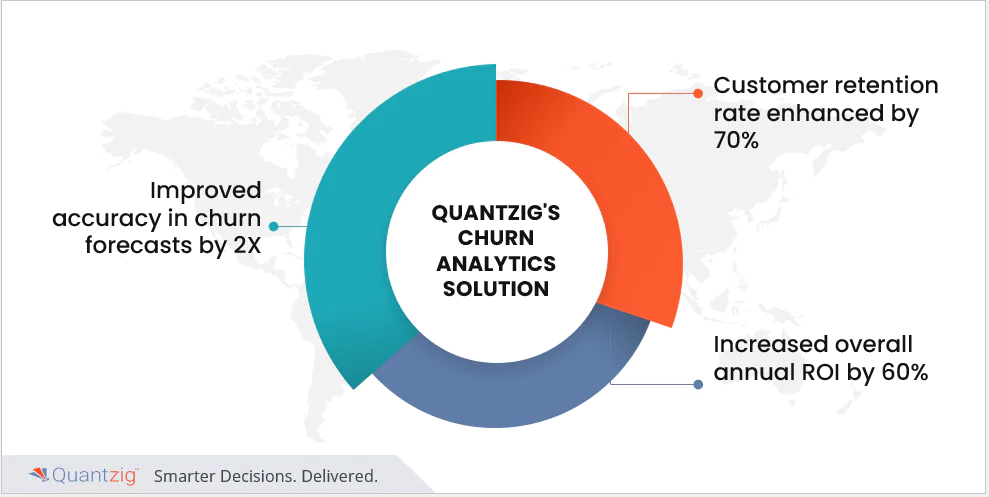

- Improved accuracy in churn forecasts by 2X

- Enhanced customer retention rate by 70%

- Improved overall annual ROI by 60%

- Improved the effectiveness of marketing campaigns

- Created new opportunities for cross-selling and upselling

- Reduced the gap between the bank’s products and customer’s needs

- Enhanced customer loyalty

- Developed a robust customer retention program

- Improved customer satisfaction level

- Increased customer base

Experience the advantages firsthand by testing a customized complimentary pilot designed to address your specific requirements. Pilot studies are non-committal in nature.

Request a free pilotConclusion

In conclusion, churn analytics in banking has emerged as a vital tool for identifying attrition risks among customers. By leveraging advanced machine learning methods and data science techniques, banks can accurately predict churn and implement targeted retention strategies. This proactive approach not only enhances customer retention and loyalty but also optimizes marketing efforts, improves financial performance, and fosters a positive brand perception. Through strategic decision-making, banks can effectively mitigate attrition risks, strengthen customer relationships, and position themselves for long-term success in the competitive banking landscape. Overall, this tool serves as a cornerstone in the banking industry, driving customer-centric initiatives and ensuring sustained growth and profitability.

Get started with your complimentary trial today and delve into our platform without any obligations. Explore our wide range of customized, consumption driven analytical solutions services built across the analytical maturity levels.

Start your free trial now