The task of determining insurance premium and claims amount to different segments of customers requires a high level of precision. To do so, healthcare insurance companies should identify high-risk customer segments effectively. As a result, healthcare insurance companies are turning towards Customer Lifetime Value Analysis (CLV Analysis) to manage patient satisfaction levels, financial resources, and master retention and acquisition practices. A thorough CLV analysis allows an organization to focus its time, capital, and energy towards profitable customers.

Book a demo to experience the meaningful insights we derive from data through our analytical tools and platform capabilities.

Request a Free DemoTable of Contents

What is CLV Analysis?

Customer Lifetime Value (CLV) Analysis is a strategic approach that helps businesses assess the total revenue a customer is expected to generate throughout their relationship with a company. By understanding CLV, businesses can make data-driven decisions to optimize marketing spend, enhance customer retention, and improve profitability. This analysis enables organizations to segment customers, personalize engagement strategies, and allocate resources efficiently to maximize long-term value.

Key Aspects of CLV Analysis:

- Customer Segmentation: Identifies high-value customers to tailor marketing efforts.

- Retention Strategies: Helps enhance customer loyalty and reduce churn.

- Revenue Forecasting: Predicts future revenue streams based on customer behavior.

- Optimized Marketing Spend: Ensures investments are directed toward profitable customer segments.

- Personalized Engagement: Enables targeted campaigns for better customer satisfaction.

- Profitability Enhancement: Focuses on long-term revenue growth and sustainability.

Opportunities Unveiled by CLV Analysis:

CLV analysis in the realm of healthcare insurance presents a wealth of opportunities. By deciphering the lifetime value of each customer, insurers can tailor their offerings to align with individual needs and preferences, thereby enhancing customer satisfaction. Additionally, CLV analysis allows companies to identify cross-selling and upselling prospects, enabling the maximization of revenue streams.

Overcoming Challenges in CLV Analysis:

Despite its potential benefits, healthcare insurance companies encounter challenges in implementing CLV analysis. One significant hurdle is the vast and varied data sources inherent in the industry. Overcoming this challenge necessitates the integration of diverse datasets, ranging from claims histories to customer interactions, ensuring a comprehensive view of each individual’s journey.

Another obstacle lies in the dynamic nature of healthcare regulations and market trends. To address this, companies must deploy agile data analytics systems capable of adapting to industry shifts swiftly. Collaborative efforts between data scientists, actuaries, and business analysts become paramount to ensure the accuracy and relevance of CLV calculations.

Moreover, the intrinsic complexity of healthcare insurance necessitates a sophisticated analytical approach. Companies should invest in advanced analytics tools and models that can navigate intricate data landscapes, providing actionable insights. This requires a commitment to ongoing skill development among personnel to harness the full potential of CLV analysis.

Experience the advantages firsthand by testing a customized complimentary pilot designed to address your specific requirements. Pilot studies are non-committal in nature.

Request a free pilot

Impact of CLV Analysis:

The implementation of CLV analysis in healthcare insurance resonates across multiple facets of the business, yielding both financial and strategic benefits. Financially, insurers witness improved profitability through targeted marketing efforts, reduced acquisition costs, and enhanced customer retention. The ability to predict customer behavior enables precise resource allocation, optimizing operational efficiency.

Strategically, CLV analysis empowers healthcare insurance companies to prioritize customer-centric initiatives. By understanding the unique needs of policyholders, insurers can craft personalized communication strategies, refine product offerings, and establish loyalty programs that resonate with their clientele. This, in turn, contributes to a positive brand image and increased customer trust.

Do Healthcare Insurance Companies need CLV Analysis?

People or companies seeking healthcare insurance for their employees respond differently to marketing variables including pricing, benefits, promotions, and distribution. Also, companies sell their product to different segment of customers, such as corporate clients who buy insurance in bulk quantities for their employee, individuals opting for Medicare plan, or individuals opting for family coverage. On that account, it is essential for healthcare insurance companies to calculate the present value of a firm’s relationship with its customers. By using CLV analysis, they can accurately estimate insurance premium rates and optimal claim value, identify the dissatisfied customer, and take measures to resolve their issue. Doing so can significantly boost their revenues and maintain a healthy and profitable customer base.

Contact us to learn more about CLV analysis and how it can benefit your organization.

How can Healthcare Insurance Companies adopt CLV Analysis?

An efficient CLV model can help increase customer satisfaction, serve patients better, and increase company profits. It is essential to devise effective CLV strategies by taking into consideration segmentation criteria and customer relationships, which assists in making informed business decisions on product, pricing, and promotion.

Key Strategies for Maximizing CLV:

1. Holistic Data Integration:

Leverage advanced technologies for the seamless integration of diverse data sources, including electronic health records, claims data, and customer interactions. A unified data environment forms the foundation for accurate CLV calculations.

2. Agile Analytics Infrastructure:

Implement an agile analytics infrastructure capable of adapting to evolving industry trends and regulatory changes. This ensures that CLV models remain robust and relevant, providing actionable insights in real-time.

4. Cross-Functional Collaboration:

Foster collaboration between data scientists, actuaries, and business analysts. Cross-functional teams can harness their collective expertise to refine CLV models, interpret results, and translate insights into strategic initiatives.

5. Continuous Skill Development:

Prioritize ongoing skill development among personnel to keep pace with advancements in data analytics. This includes training programs, workshops, and certifications to equip teams with the knowledge and skills required for effective CLV analysis.

6. Customer-Centric Initiatives:

Tailor marketing strategies, product offerings, and customer interactions based on CLV insights. Implement loyalty programs, personalized communication channels, and value-added services that resonate with the unique needs of each customer segment.

How can Quantzig’s team of CLV experts help vendors in healthcare insurance?

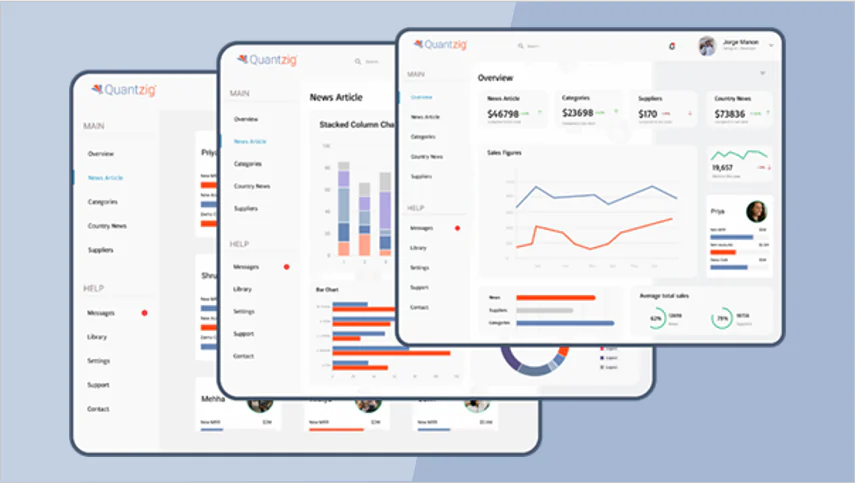

- Provide a concise dashboard with compiled information on customer behavior and provide details on-demand.

- Develop a full-proof CLV model to gain relevant insights on the customer landscape.

- Estimate churn rates and identify cross-selling and up-selling opportunities.

Enter Quantzig:

Today, managers have access to a large stream of data, and decision-making on the basis of gut-feeling, the rule of thumb, and guessworks are largely eliminated with the advent of data analytics.

“Without big data analytics, companies are blind and deaf, wandering out onto the web like a deer on a freeway,” said a leading data analytics expert from Quantzig.

For more than 14 years, we have assisted our clients across the globe with end-to-end data management and analytics services to leverage their data for prudent decision making. Our firm has worked with 120+ clients, including 55+ Fortune 500 companies. At Quantzig, we firmly believe that the capabilities to harness maximum insights from the influx of continuous information around us is what will drive any organization’s competitive readiness and success. Our objective is to bring together the best combination of analysts and consultants to complement our clients with a shared need to discover and build those capabilities and drive continuous business excellence.

Get started with your complimentary trial today and delve into our platform without any obligations. Explore our wide range of customized, consumption driven analytical solutions services built across the analytical maturity levels.

Start your free trialConclusion

In conclusion, conducting a comprehensive Customer Lifetime Value (CLV) analysis is vital for businesses aiming to optimize their customer relationships and profitability. By leveraging key CLV metrics and employing accurate CLV calculations, businesses can enhance their understanding of customer value. Advanced techniques such as predictive CLV analysis, CLV prediction models, and CLV analysis tools empower companies to forecast future customer behaviors and refine their customer retention strategies. CLV analysis for businesses and CLV segmentation offer valuable insights for targeted marketing efforts, while CLV optimization ensures that every customer interaction maximizes profitability. By focusing on CLV analysis for marketing, companies can unlock growth opportunities by predicting and improving customer value, making CLV data analysis an indispensable part of any successful business strategy. Ultimately, mastering how to calculate customer lifetime value is key to long-term success.