The banking sector is currently navigating a complex landscape of difficulties and challenges, with key obstacles like regulatory pressures, operational risks, and technological transformation impacting the industry. Among the challenges encountered by banks are issues such as security concerns, compliance demands, and adapting to current trends while ensuring customer trust. Financial institutions face banking sector hurdles like maintaining competitiveness in a rapidly evolving digital space, which adds to the problems in the banking industry. These banking industry pressures have led to struggles within the financial sector, where institutions must address emerging challenges like cybersecurity, increased competition, and shifting customer expectations. Solutions for these challenges in the banking industry are essential to overcoming the barriers and banking sector risk factors in today’s landscape.

Book a demo to experience the meaningful insights we derive from data through our analytical tools and platform capabilities. Schedule a demo today!

Request a no-cost pilotTable of Contents

Embracing Digital Transformation in Banking: Why It’s Essential

The Power of Technology: Turning Disruption into Opportunity

While these challenges may seem daunting, the same technologies driving disruption can also provide the solutions. However, transitioning from legacy systems to modern, innovative solutions is no small feat. To truly thrive, banks and credit unions must embrace digital transformation, leveraging technology to not only survive but to lead in this new financial era.

Navigating the Regulatory Maze

With the increasing frequency of data breaches and heightened privacy concerns, regulatory and compliance requirements have become more stringent. Financial institutions must navigate this complex landscape while ensuring they meet customer demands and maintain trust.

At Quantzig, we understand the complexities of the banking industry and have years of experience helping clients successfully navigate these changes. Our expertise in digital transformation enables financial institutions to not just adapt, but to excel, positioning them at the forefront of the industry. Let us help you turn disruption into opportunity and lead the way in the future of banking.

Experience the advantages firsthand by testing a customized complimentary pilot designed to address your specific requirements. Pilot studies are non-committal in nature.

Get in touch with our teamChallenges that are hovering within the Banking Sector

1. Traditional banking habits

As mentioned earlier, 51% of US adults participate in online banking, however, in the hindsight, 49% of them still don’t. A majority of such people are susceptible to change and are well versed in traditional banking. Such aversion to change is usually due to a lack of trust in the online system or the inability to operate online portals. As a result, banks are struggling to convince people to adopt online banking. In this case, banks can simply demonstrate the benefits and the drawbacks of traditional banking to their customers.

2. Security and fraud instances

Security and protection against fraud and hacking are some of the most significant problems for banks promoting online banking. In traditional banking, robbers would have to break into the bank to steal money from customers. However, skilled hackers can crack bank security measures to get customers detail and illicitly transfer money. For instance, almost 130 million British pounds were stolen from online bank accounts in 2015 through fraud. Additionally, the expansion of e-commerce provides an opportunity for fraudsters to misuse payment networks and steal sensitive information.

Quantzig’s financial analytics dashboard is a cutting-edge solution that empowers businesses with unparalleled insights into their financial data. This comprehensive dashboard seamlessly integrates advanced analytics and visualization tools, offering a real-time and holistic view of key financial metrics. With our expertise in data analytics, the financial dashboard provides detailed analyses of revenue streams, expenditure patterns, and overall financial performance. The user-friendly interface allows for easy navigation and customization, enabling decision-makers to drill down into specific financial aspects and uncover actionable insights.

3. Cross-border transactions

One of the critical success factors is the implementation of the cross-border transaction as they play a vital role in global trade. However, historically, cross-border payments have been slow, inefficient, and expensive. This is because most of the banks still use traditional infrastructure including national banking infrastructure which results in non-uniform development and software platforms that complicate the cross-border transaction. New technologies including blockchain have been promising in overcoming such drawbacks to facilitate smooth cross-border transactions.

4. Technical issues

Banks are heavily reliant on online platforms to perform operational tasks including cash transfers, transaction recording, and information storing. A single system crash or a bug in their code can cause millions of dollars in losses or can even cause the bank to shut down its operations temporarily. Similarly, customers can lose trust in online banking when it’s not functional for that time. So banks face challenges in not only running their online platforms smoothly but also look towards their mobile apps.

5. Multi-currency and payment methods

The rise of global e-commerce has posed new problems in this sector, that of using multiple currencies and payment methods. Consumers around the world use various payment methods including credit card, debit card, PayPal, bank transfers, e-wallets, and mobile payments. Merchants accept payments through such means and in different currencies. However, they face difficulty dealing with multi-currency, cross-border transactions, bank accounts, business entities, and regulatory hurdles. Such issues can usually be solved by selecting a payment service provider who can provide effective and immediate solutions to these problems.

6. Legacy System Integration and Digital Transformation:

The online banking sector grapples with the challenge of seamlessly integrating digital transformation initiatives with existing legacy systems. Transitioning from manual processes to digitized experiences requires substantial investments in technology and expertise to overcome resistance from traditional banks with established business models.

7. Cybersecurity and Data Protection:

In the digital world, the increasing reliance on mobile experiences and online transactions exposes financial institutions to heightened security risks. Security breaches, despite implementing measures like End-to-End Encryption (E2EE), biometric authentication, and risk-based authentication (RBA), remain a persistent concern, impacting customer trust and raising shareholder expectations for robust data security.

8. Adapting to Evolving Customer Expectations:

Meeting and exceeding customer expectations in a rapidly changing landscape pose a significant challenge. Customers demand digitized experiences, personalized services, and seamless mobile banking solutions. Striking a balance between proprietary trading, shareholder expectations, and customer loyalty becomes complex, especially with the emergence of digital natives who prefer innovative financial technology (fintech) solutions.

9. Navigating Regulatory Landscape and Compliance:

Financial institutions operating in the online banking sector must contend with a complex regulatory environment. Compliance with standards such as Current Expected Credit Loss (CECL), risk-weighted capital requirements, and Address Verification Service (AVS) is crucial. Managing regulatory requirements, including those related to cryptocurrency and financial technology (fintech), adds complexity to the business models of traditional banks and smaller institutions alike. The pressure to comply with regulations while innovating and maintaining a competitive edge is a continuous challenge.

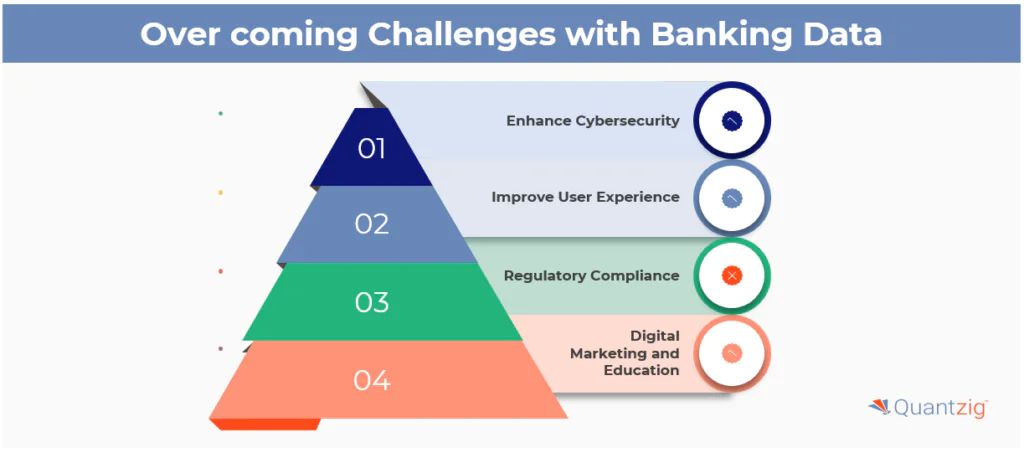

How to overcome the challenges hindering the Growth of the Banking Sector?

Overcoming the challenges of banking sector requires a multi-faceted approach that focuses on technology, security, customer experience, and regulatory compliance. Here are four keyways to address these challenges:

| Challenge | Overcoming the Challeges |

|---|---|

| Rising Competition | The rise of FinTechs poses a significant threat to traditional financial services, particularly in highly profitable sectors. These new entrants are compelling financial institutions to explore partnerships and acquisitions as they strive to maintain competitiveness. To stay ahead, banks and credit unions must learn from the streamlined, intuitive customer experiences offered by FinTechs. Quantzig’s expertise in digital transformation can help these institutions adapt and thrive in this evolving landscape. |

| Cultural Shift | Technology has become an integral part of our culture, and this extends to the banking industry. Financial institutions must embrace a technology-first approach, optimizing processes for maximum efficiency. Quantzig’s experience in driving digital transformation helps banks and credit unions foster a culture of innovation, ensuring they stay competitive in a rapidly changing environment. |

| Regulatory Compliance | Regulatory compliance remains one of the most pressing challenges in the financial services industry, with increasing regulations placing significant strain on resources. Financial institutions must implement robust compliance structures and leverage technology to manage compliance risks effectively. Quantzig offers expert solutions that help banks navigate complex regulatory environments, ensuring they meet all requirements while minimizing costs. |

| Changing Business Models | Financial institutions are under pressure to adapt to changing business models due to rising compliance costs, low-interest rates, and evolving shareholder expectations. To maintain profitability, they must innovate and optimize operations. Quantzig’s strategic insights and expertise in business process transformation enable banks to pivot and succeed in this dynamic landscape. |

| Rising Expectations | Today’s consumers demand personalized, convenient banking experiences across all channels. With generational shifts leading to higher expectations for digital interactions, financial institutions must adopt hybrid banking models. Quantzig’s deep understanding of consumer behavior and omnichannel strategies empowers banks to exceed customer expectations while driving long-term loyalty and satisfaction. |

| Customer Retention | Customer loyalty is increasingly difficult to maintain in the financial services sector. Rich client relationships, driven by a deep understanding of customer needs, are essential for reducing churn. Quantzig specializes in enhancing customer engagement through data-driven insights and advanced technologies, helping financial institutions retain clients and increase wallet share. |

| Outdated Mobile Experiences | A mobile banking app must be fast, user-friendly, and secure to meet modern consumer expectations. Quantzig’s expertise in mobile strategy and app development ensures that banks and credit unions can offer cutting-edge digital experiences that keep customers satisfied and engaged. |

| Security Breaches | With the growing prevalence of security breaches, financial institutions must invest in advanced technology-driven measures to protect sensitive customer data. Quantzig’s innovative solutions in cybersecurity help banks safeguard their customers’ information, ensuring trust and confidence in their services. |

| Antiquated Applications | Antiquated systems and siloed applications can hinder an institution’s ability to thrive in a digital-first world. Digital transformation is no longer optional but a necessity for survival. Quantzig’s expertise in cloud computing, AI, and other advanced technologies empowers banks to modernize their infrastructure, reduce costs, and enhance customer experiences. |

| Continuous Innovation | Continuous innovation is key to long-term success in the financial services industry. Benchmarking alone is not enough; institutions must also drive innovation to remain competitive. Quantzig’s insights and technological solutions enable banks to innovate faster and more effectively, ensuring they stay ahead in the digital transformation race. |

Why Choose Quantzig to Solve your Banking Challenges?

Quantzig empowers financial institutions with advanced AI, analytics, and digital solutions, transforming business models and enhancing customer experiences. Our expertise drives strategic growth, security, and market differentiation in the evolving landscape of retail banking.

| Focus Area | Quantzig’s Solution |

|---|---|

| AI & Analytics for Business Models | Quantzig leverages AI to enhance business models in online banking, proprietary trading, and low-interest rate challenges. This includes competition analysis, brand reinforcement, location analysis, target demographic identification, and market research. |

| Data-Driven Customer Retention | Using market research, Quantzig develops strategies to improve customer retention and loyalty by analyzing target demographics and competition, reducing turnover, and enhancing brand identity through location analysis. |

| Digital Transformation via Cloud | Quantzig aids financial institutions in adopting hybrid banking models with cloud computing, offering scalable processes and tech solutions. Our market research and location analysis identify strategic opportunities for brand optimization. |

| Security & Risk Assessment | Quantzig provides data security solutions, focusing on mobile banking security and advanced authentication (OOBA). We leverage AI to enhance fintech collaborations, omnichannel reach, and ensure regulatory compliance, building customer trust. |

| Omnichannel Marketing & Engagement | Quantzig empowers FIs to create effective omnichannel marketing strategies using analytics, incorporating digital, social media, and event promotions to enhance customer experience in retail banking. |

| Branch Transformation & Location Analysis | Quantzig’s location analysis optimizes branch transformation by analyzing local factors and trade areas. Our expertise in AI, BI, and data analytics helps FIs navigate regulatory compliance and succeed in the digital era. |

Get started with your complimentary trial today and delve into our platform without any obligations. Explore our wide range of customized, consumption driven analytical solutions services built across the analytical maturity levels.

Request a no-cost pilotTransforming Financial Services with Quantzig’s Tailored Solutions

Quantzig’s cutting-edge solutions empower financial institutions to overcome industry challenges and stay competitive. By leveraging advanced analytics, digital transformation strategies, and innovative technologies, Quantzig helps banks and credit unions enhance customer experiences, streamline operations, and drive sustainable growth. Our expertise ensures that your institution is well-equipped to navigate regulatory landscapes, modernize outdated systems, and continuously innovate in a rapidly evolving market.