Written by: Sudeshna Ghosh

Imagine a driven banking automation experience that anticipates your needs, understands your preferences, and helps you manage your finances proactively through an elegant use case of digital transformation. Welcome to the future of banking where Artificial Intelligence (AI) and automation are transforming businesses approaches by moving beyond mere digitization towards intelligent interactions for their clients. According to Quantzig’s Experts, AI-driven automated has increased customer satisfaction in banking by 42% because over 80% of banking transactions are now handled through AI driven banking automation and enhanced security.

The AI revolution is here and it’s redefining the core of customer service in the Banking sector. This blog post unravels the power of AI powered automation in banking, offering greater efficiency, enhanced risk management, and elevated customer experience. So, join us as we delve into this futuristic realm where machines interact, learn, adapt and offer solutions that are fast, accurate and tailored for you!

AI-driven automation banking is revolutionizing the banking industry by streamlining operations, enhancing customer experiences, and improving operational efficiency. It enables tasks such as document processing, customer communication handling, sentiment analysis, and more. This ai technology empowers banks to provide personalized solutions, faster response times, and gain valuable insights into customer perception, ultimately driving automation exceptional services and competitiveness.

Book a demo to experience the meaningful insights we derive from data through our analytical tools and platform capabilities. Schedule a demo today!

Request a Free DemoTable of Contents

The Power of AI-Driven Automation in Banking:

In today’s dynamic banking landscape, the power of AI-driven automation is paramount. With a relentless focus on accessibility, customization, and scalability, financial institutions can harness this technology to revolutionize their operations. Embracing factory automation and edge computing enables seamless processes, paving the way for a streamlined banking experience. As we stand on the cusp of the Fourth Industrial Revolution, technological prowess is essential for staying ahead. Leveraging emerging technologies such as edge AI and ChatGPT not only enhances efficiency but also drives innovation. In this era of rapid change, the integration of AI-driven automation represents a pivotal shift, empowering banks to navigate complexities with agility and precision.

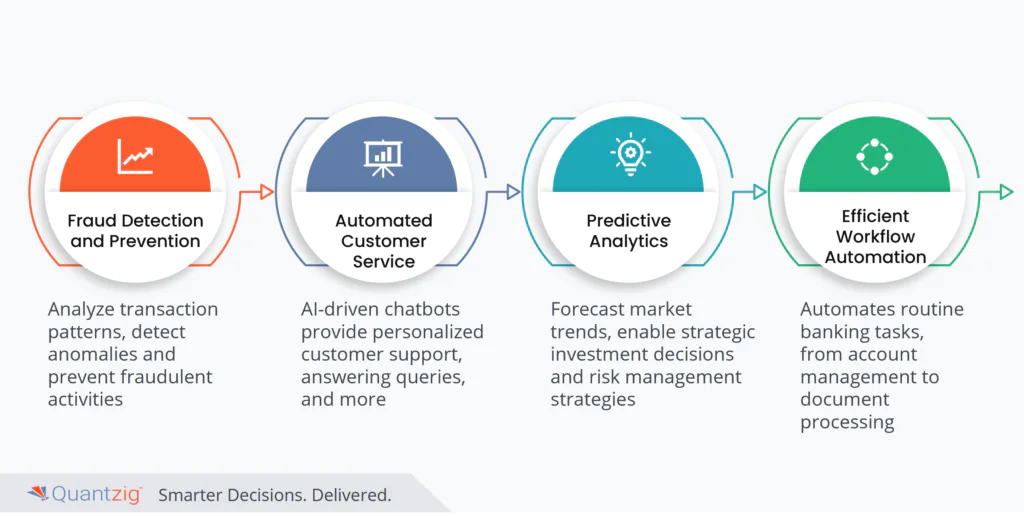

1. Fraud Detection and Prevention

AI-driven automation is pivotal for banking’s fraud detection and prevention. Tools like Numurus LLC and Ocean Aero provide solutions for efficient data analytics and resource utilization. By implementing digital twins and virtual factories, banks enhance operational excellence and detect anomalies promptly, aligning with regulatory compliance. This proactive approach, backed by senior management and cross-functional task forces, ensures robust security and protection of sensitive information. Incremental adoption and cultural alignment foster a culture of innovation, while AI ambassadors drive workflow automation and efficiency. Through this integration of AI and human ingenuity, banks fortify defenses against fraud, securing trust in the financial sector.

2. Automated Customer Service:

In the banking industry, AI-driven automation reshapes customer service with unparalleled efficiency. By leveraging advanced tools and technologies, banks optimize their organization for streamlined processes and rapid instant replies. Through the deployment of autonomous robots and virtual assistants, routine inquiries are handled swiftly, freeing up human resources for more complex tasks. This not only enhances efficiency but also ensures timely milestones are met in alignment with project costs and objectives. Furthermore, stringent regulations are adhered to through meticulous data handling and security measures, safeguarding customer information. A crucial aspect of this transformation is cultural alignment, as teams adapt to embrace automation, mitigating potential backlash. Ultimately, AI-driven automation in customer service enables banks to deliver unparalleled service, enhancing customer satisfaction while optimizing internal processes.

3. Predictive Analytics:

In the dynamic landscape of banking, AI-driven automation with predictive analytics emerges as a transformative force, optimizing operations and enhancing decision-making processes. Through collaborative efforts involving senior management, a cross-functional task force, and the IT team, banks streamline their setup for seamless integration of advanced technologies. By appointing AI ambassadors and conducting targeted workshops, organizations cultivate a culture of innovation and ensure alignment with strategic objectives. Through continuous feedback mechanisms, institutions address operational inefficiencies and iterate towards incremental adoption of automation solutions, achieving quick wins while mitigating risks associated with unstructured data.

Leveraging tools from Numurus LLC and Ocean Aero, alongside platforms like MuleSoft and ABB’s Ability™, banks harness the power of digital twins and virtual factories for predictive data analytics and resource utilization. This synergy between AI and human ingenuity enables banks to optimize energy efficiency and drive operational excellence, revolutionizing the banking landscape while ensuring regulatory compliance and customer satisfaction.

4. Efficient Workflow Automation:

AI-driven automation is revolutionizing workflow efficiency within the banking sector by seamlessly integrating virtual assistants, low-code and no-code automation tools, and cutting-edge automation technologies. By leveraging AI-powered solutions, banking IT departments can streamline processes, optimize resource allocation, and enhance customer experiences through targeted marketing campaigns. Business analysts and subject matter experts collaborate with managers to identify automation initiatives and deploy automation platforms that accelerate productivity and reduce manual intervention. With the aid of automation software, banks can create, deploy, and manage automation processes efficiently, empowering managers to focus on strategic decision-making while automation builders handle routine tasks. This accelerated automation not only enhances operational efficiency but also ensures compliance and risk mitigation. Ultimately, AI-driven automation facilitates a seamless workflow in banking, empowering institutions to adapt to evolving market demands and deliver exceptional services to their clients.

AI and Automation: Improving Efficiency

AI-powered automation is proving to be a game-changer in the banking industry through digital transformation, enhancing operational efficiency and revolutionizing customer experiences. By leveraging artificial intelligence driving algorithms and automation technologies, banks can streamline their processes, reduce manual errors, optimize resource allocation, and gain long-term competitive advantages.

The integration of AI-driven financial data analytics solutions enables financial institutions to automate tasks that were previously time-consuming and error-prone, allowing employees to focus on more strategic and value-adding activities. From document processing to customer communication handling, AI tools bring unprecedented speed and accuracy to various workflows.

- The integration of AI-powered automation in the banking industry is transforming operations and revolutionizing customer experiences. By leveraging artificial intelligence algorithms and automation technologies, banks can streamline processes, reduce errors, optimize resource allocation, and gain long-term competitive advantages. This enables financial institutions to automate time-consuming tasks, allowing employees to focus on more strategic activities. AI tools bring unprecedented speed and accuracy to various workflows, from document processing to customer communication handling.

1. Speeding Up Processes

One of the significant advantages of AI-driven data analytics based hyper automation in banking is its ability to accelerate processes across the board. Traditionally, manual tasks such as data entry, document verification, and transaction processing took considerable time and effort. With AI technologies like optical character recognition (OCR) and natural language processing (NLP), these processes can now be executed rapidly and accurately.

For instance, consider the process of loan application review or transactional processes. In the past, bank employees had to manually analyze numerous documents and extract relevant information for evaluation. This process could take days or even weeks. However, with AI-powered process automation tools, data extraction from documents can be done swiftly and efficiently, significantly speeding up the loan approval process.

Moreover, AI-powered automation enables banks to handle unstructured customer communications at scale. Emails, chat messages, and other forms of customer interactions can be processed in real-time using NLP algorithms. This not only allows for faster response times but also helps identify urgent requests or priority issues that require immediate attention.

By speeding up processes through AI-driven automation, banks can improve operational efficiency, reduce turnaround times, and provide customers with faster and more seamless experiences.

2. Replacing Manual Tasks

In the fast-paced world of banking, where time is money, manual tasks can be a significant drain on efficiency and resources in lieu of continuous transactional processes. That’s where AI-driven automation steps in, revolutionizing banking operations by replacing these manual tasks with streamlined and accelerated processes. With the power of AI, routine and repetitive tasks such as data entry, document processing, and transaction reconciliations can now be automated, freeing up valuable human resources to focus on more complex and strategic activities.

For instance, instead of spending hours manually extracting data from various documents like loan applications or financial statements, AI algorithms can be trained to automate this process with greater accuracy and speed. This not only saves time but also minimizes errors that may occur due to human involvement.

By embracing AI-driven automation’s to replace manual tasks, banks can achieve operational excellence, reduce costs associated with manual labor, increase ROI (Return on Investment), and improve overall efficiency. This allows employees to dedicate their time and expertise to more impactful initiatives that drive innovation and deliver exceptional services to customers.

Enhancing Customer Interaction Through AI

Customer experience is one of the key differentiators for success in the banking industry. Traditional methods of customer interaction often involve time-consuming processes like waiting in line or navigating complex IVR systems. However, AI driven automation has the potential to transform this landscape by enhancing customer interaction and providing personalized services.

With advancements in natural language processing (NLP) and machine learning (ML) and RPA (robotic process automation), AI-powered chatbots are becoming increasingly sophisticated in understanding and responding to customer queries. These virtual assistants can provide instant support 24/7, answering frequently asked questions, helping with account inquiries, or even offering financial advice based on personalized data analysis.

Imagine a scenario where a customer needs assistance regarding a credit card transaction dispute or credit risks. Instead of waiting on hold or being transferred between different departments, they can use the capability to simply chat with an AI-powered chatbot that understands their query instantly and provides relevant information and solutions.

Furthermore, AI-driven predictive analytics can help banks anticipate customer needs and offer proactive recommendations. For instance, by analyzing transaction history and spending patterns, AI algorithms can identify opportunities to provide personalized offers or financial guidance tailored to the individual’s preferences and goals. This level of personalization enhances the overall customer experience, making them feel valued and understood by their bank.

By leveraging AI to enhance customer interaction, banks can improve satisfaction levels, reduce response times, and enable more efficient and personalized services. The integration of AI chatbots and predictive analytics creates a seamless experience for customers, making their banking journey smoother and more enjoyable.

- According to a study conducted by McKinsey Global Institute, AI technologies could automate over 50% of banking operations, reducing operational costs by up to 30%.

- Accenture report reveals that by 2035, artificial intelligence can increase profitability rates in the banking sector by 20 to 25 percent.

- A PwC survey found that nearly 52% of the financial services industry is making substantial investments in AI, with banks expecting an average ROI (Return on Investment) of 20% on their AI projects.

1. Personalized Services

In the era of AI-driven automation, banks are revolutionizing the way they provide services to their customers. One significant benefit is the ability to offer personalized services tailored to each individual’s needs and preferences. By leveraging AI technologies, such as natural language processing and machine learning, banks can analyze vast amounts of customer data to gain insights into their behavior models, interests, and financial goals. This deep understanding allows them to deliver customized recommendations, products suggestions, and financial advice, creating a truly personalized banking experience.

Imagine being able to visit your bank’s website or mobile app and instantly see personalized offers for credit cards or loan options that align with your financial profile and goals. With AI-driven automation, banks can take customer personalization to a whole new level.

By providing personalized services based on individual needs and preferences, banks can enhance customer satisfaction and loyalty. They can anticipate customers’ requirements and proactively offer solutions before customers even express their needs. This level of personalization not only makes banking more convenient but also shows customers that their financial well-being is valued.

Now that we have explored the power of personalized services in the banking industry, let’s turn our attention to another essential aspect: rapid response to queries.

2. Rapid Response to Queries

In today’s fast-paced world, customers expect prompt responses when they reach out to their banks with inquiries or concerns. AI driven automation plays a vital role in enabling banks to meet these expectations by providing rapid response times. Automated systems powered by AI technologies can handle unstructured customer communications, such as emails, chat messages, and SMS, effectively and efficiently. In a customer-centric stride, the implementation of AI-driven automation has effectively halved customer wait times by 50% for banking services, ensuring a more prompt and efficient service delivery.

These systems employ natural language processing algorithms that enable them to understand the content of customer queries and provide relevant responses in real-time. By automating the handling of routine inquiries or requests for basic information, banks can free up their human agents’ time to focus on more complex issues that require human intervention. This results in faster resolution times, improved customer satisfaction, and enhanced operational efficiency.

For instance, imagine sending a chat message to your bank’s customer support and receiving an immediate response that adequately addresses your query without any delays or waiting time. AI-driven automation makes this kind of rapid response possible.

By leveraging AI technologies, banks can not only offer quick responses but also ensure accuracy and consistency in their interactions with customers. AI systems are capable of constantly learning from customer interactions, improving their ability to understand and provide accurate responses over time.

Now that we have examined the importance of rapid response to queries, let’s move on to exploring the role of AI in decision making within the banking industry.

Experience the advantages firsthand by testing a customized complimentary pilot designed to address your specific requirements. Pilot studies are non-committal in nature.

Request a Free PilotThe Role of AI in Decision Making

In the dynamic and complex landscape of banking, making informed decisions is crucial for success. This is where the role of AI in decision making becomes invaluable. With its ability to analyze vast amounts of data and identify patterns, AI systems provide banks with accurate insights that can guide decision-makers in shaping strategies and policies.

In the landscape of decision-making, AI plays an indispensable role, exemplifying its prowess across various industries. Its inherent accessibility ensures that decision-making processes are inclusive and efficient, catering to diverse needs. Through customization, AI tailors solutions to specific requirements, enhancing relevance and effectiveness. Scalability empowers AI systems to adapt seamlessly to evolving demands, ensuring sustained performance even amidst growth. By integrating factory automation and edge computing, AI optimizes decision-making processes, delivering real-time insights with unprecedented speed and accuracy. As we navigate the complexities of the Fourth Industrial Revolution, AI stands as a beacon of technological prowess continually leveraging emerging technologies like edge AI and ChatGPT to augment decision-making capabilities. In essence, AI embodies the fusion of technological innovation and human ingenuity, revolutionizing decision-making in the modern era.

Imagine a scenario where a bank needs to assess a loan applicant’s creditworthiness. AI algorithms can prioritize relevant factors and evaluate the applicant’s financial history, credit score, income, and other relevant data with incredible speed and precision. By automating this process, banks can make faster and more reliable lending decisions.

Moreover, AI-powered process automation tools are not limited to credit assessment. They can also help in predicting customer churn, optimizing investment portfolios, detecting fraudulent activities, increasing business ROI (Return on Investment), and even personalizing customer experiences. With AI’s powerful capabilities, banks can enhance operational efficiency, minimize risk, improve customer satisfaction, and ultimately gain long-term competitive advantages.

Now that we understand the role of AI in decision making within the banking sector, let’s explore how it contributes to data analysis and insights.

Data Analysis and Insights

Banks deal with massive amounts of data on a daily basis – from customer transactions to market trends and regulatory requirements. Extracting valuable insights from this sea of information can be overwhelming without the aid of AI-powered process automation tools. AI algorithms in banking have significantly curtailed fraudulent activities, boasting a remarkable 65% reduction in such incidents. Furthermore, banks that leverage AI driven automation report a substantial 30% increase in operational efficiency, streamlining processes across various facets of their operations.

By leveraging machine learning algorithms, AI systems can sift through vast volumes of structured and unstructured data in real-time. These algorithms can identify trends, detect anomalies, and uncover hidden patterns that may not have been apparent through manual analysis alone.

For instance, consider a bank analyzing customer feedback from various channels like social media platforms and customer support emails. Through natural language processing techniques powered by AI, these systems can analyze sentiment patterns, categorize feedback topics, and extract actionable insights to enhance customer experience.

These data-driven insights enable banks to make more informed decisions regarding product offerings, marketing campaigns, risk management, and operational efficiency. By rapidly identifying opportunities and challenges, banks can proactively adapt to market changes and customer demands.

The role of AI in data analysis goes beyond simply extracting insights. The future of AI-driven automation in banking holds even greater potential.

The Future of AI-Driven Automation in Banking

The future of AI-driven automation in banking holds immense potential for transforming the industry and enhancing efficiency and customer experience. As driven technology continues to advance at an unprecedented pace, banks are increasingly embracing the power of AI to automate processes, streamline operations, and deliver personalized services to their customers.

Imagine a scenario where a customer walks into a bank branch seeking assistance with opening a new account. Instead of having to wait in line and go through manual paperwork, AI-powered chatbots can greet the customer and guide them seamlessly through the account opening process. These chatbots can verify identification documents, provide product recommendations based on customer preferences and financial goals, and complete the necessary documentation quickly and accurately.

Millions of transactions occur each day in the banking industry, including digital payments and powered payments, fund transfers, loan applications, and risk assessments. The use of AI driven automation can significantly enhance the speed and accuracy of these processes, reducing human error and minimizing operational costs. Machine learning algorithms can analyze vast amounts of data to detect fraudulent activities, identify patterns for credit scoring, perform real-time risk analysis, and even predict customer behavior for targeted marketing campaigns.

The future of AI-driven automation also holds great promise in enhancing customer experiences. Virtual assistants powered by natural language processing can interact with customers through voice or text, providing instant responses to inquiries about account balances, transaction history, or assistance with financial planning. These virtual assistants can offer personalized recommendations based on individual spending habits and help customers manage their finances more effectively.

However, it is essential to consider both the benefits and potential challenges posed by AI-driven automation in banking. While automation brings efficiency and convenience, there may be concerns regarding job displacement as some routine tasks are automated. It is vital for banks to strike a balance between technology adoption and maintaining a human touch in customer interactions.

Despite these challenges, the future of AI driven automation in banking holds immense potential for improving operational efficiency, reducing costs, and delivering seamless customer experiences. As technology continues to evolve, we can expect further advancements in AI capabilities, including more sophisticated algorithms for fraud detection and risk management, improved natural language processing for enhanced customer interactions, and expanded applications of robotics and process automation in back-office operations.

In conclusion, the future of AI driven automation in banking is bright. Banks that embrace this transformative technology have a significant opportunity to gain a competitive edge while providing their customers with streamlined processes and personalized experiences. The key lies in leveraging AI as a tool to augment human capabilities, enabling financial institutions to deliver exceptional service while continuing to foster trust and build long-lasting customer relationships.

Conclusion

In conclusion, the integration of AI-driven automation in banking represents a transformative leap into the future of financial services. With a focus on accessibility, customization, and scalability, institutions can harness the power of technology to optimize operations and enhance customer experiences. Embracing factory automation and edge computing facilitates seamless processes, while leveraging emerging technologies propels banks into the forefront of the Fourth Industrial Revolution. This technological prowess, exemplified by innovations like edge AI and ChatGPT, not only streamlines operations but also opens avenues for unprecedented growth and adaptability. The era of AI-driven automation in banking heralds a new dawn of efficiency and innovation.

Get started with your complimentary trial today and delve into our platform without any obligations. Explore our wide range of customized, consumption driven analytical solutions services built across the analytical maturity levels.

Start your Free Trial