Written by: Medha Banerjee

Table of Contents

Key Takeaways for Financial Analysis:

- Financial analytics provides crucial insights that help businesses solve problems and stay competitive by leveraging data-driven decision-making.

- By analyzing financial data, companies can enhance financial planning, budgeting, and forecasting, leading to better resource allocation and informed strategic decisions.

- Financial analytics identifies potential financial risks early, allowing businesses to take proactive steps to mitigate them and ensure stability.

- By measuring key performance indicators (KPIs) and utilizing advanced analytical techniques, businesses can drive profitability and sustainable growth.

An analytical approach to businesses is the ultimate method to help you with your business problems in the competitive world that we live in today. When it comes to the financial aspect, taking a financial analytical approach propels the implementation of the solutions required and drives better results.

Let’s dive into the fascinating world of Financial Analytics and explore its crucial role in business decision-making. In this blog, we’ll discuss the importance of financial analytics, its benefits, and the key metrics that drive effective financial performance management. Buckle up, and let’s get started!

What does Financial Analytics mean?

Financial analytics is the process of analysing and interpreting financial data to gain insights that can inform business decisions. It involves the use of various techniques, including data mining, data visualization, and predictive modelling, to identify trends, patterns, and correlations within financial data. Financial analytics can be applied to a wide range of financial data, including financial statements, market data, and customer data.

Financial analytics is a crucial aspect of modern business management. It involves the use of statistical and mathematical techniques to analyse and interpret financial data, providing valuable insights that can inform strategic business decisions.

Financial Performance Management and Analytics (FP&A) is a strategic approach that leverages data analysis to enhance an organization’s financial health, optimize return on investment (ROI), and drive overall performance. By dissecting core financial data points, FP&A provides valuable insights that empower businesses to make informed decisions.

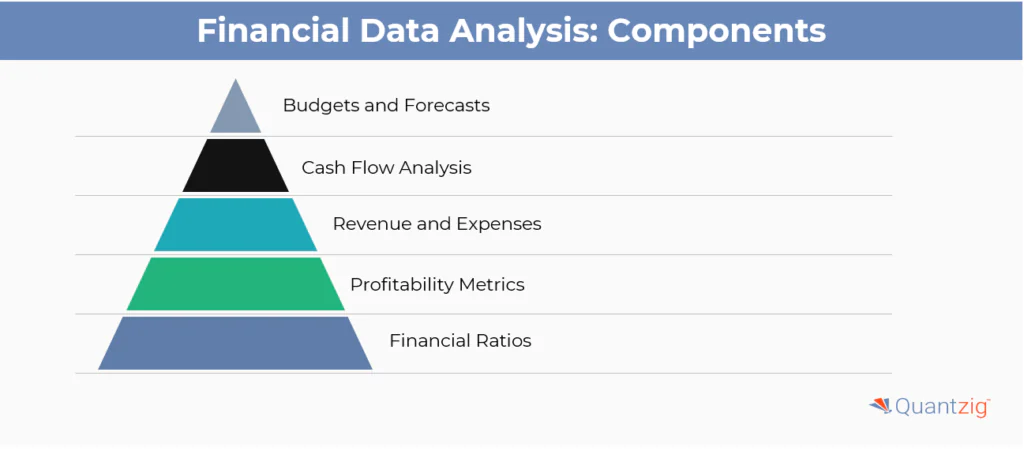

The Core Components of Finance Data Analysis

- Budgets and Forecasts: FP&A involves creating realistic financial forecasts based on historical data and current trends. Accurate budgeting ensures efficient resource allocation and helps organizations stay on track.

- Cash Flow Analysis: Understanding cash flow patterns is essential for managing liquidity, investments, and operational expenses. Effective cash flow analysis prevents financial bottlenecks and ensures stability.

- Revenue and Expenses: Analyzing revenue sources and cost structures reveals profitability drivers. It helps identify areas for improvement and cost-cutting opportunities.

- Profitability Metrics: Metrics like gross margin, net profit margin, and operating profit margin provide insights into overall profitability. These metrics guide strategic decisions.

- Financial Ratios: Ratios such as debt-to-equity, current ratio, and return on assets (ROA) help evaluate financial health and risk exposure.

Book a demo to experience the meaningful insights we derive from data through our analytical tools and platform capabilities. Schedule a demo today!

Request a Free DemoHow Financial Analytics Works?

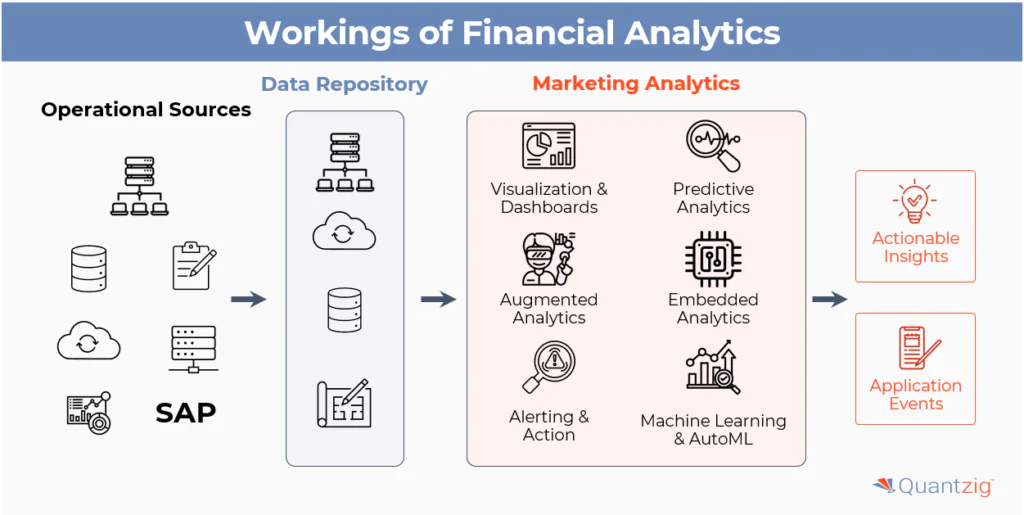

Financial analytics is a powerful tool that uses data to provide insights into an organization’s financial health and guide strategic decision-making. Here’s how it works:

1. Data Collection

The process begins with the collection of relevant financial data. This data can come from various sources such as financial statements, transaction records, market data, and other internal and external sources.

2. Data Integration

Collected data is then integrated into a centralized system. This integration often involves cleaning and organizing the data to ensure accuracy and consistency. Advanced tools and software are used to streamline this process, allowing for seamless data management.

3. Data Analysis

Once the data is integrated, sophisticated analytical techniques are applied. These techniques include statistical analysis, trend analysis, predictive modeling, and scenario analysis. Financial analysts use these methods to identify patterns, trends, and anomalies within the data.

4. Performance Measurement

Key performance indicators (KPIs) are established to measure various aspects of financial performance. These KPIs might include revenue growth, profit margins, return on investment (ROI), and cost efficiency. Tracking these metrics helps in assessing the organization’s progress towards its financial goals.

5. Risk Assessment

Financial analytics also involves identifying potential risks. By analyzing historical data and market trends, organizations can anticipate potential financial risks and take proactive measures to mitigate them. This includes assessing credit risk, market risk, and operational risk.

6. Forecasting and Budgeting

With the insights gained from data analysis, organizations can create more accurate forecasts and budgets. Predictive analytics helps in projecting future financial performance based on historical data and current trends. This enables more strategic financial planning and resource allocation.

7. Decision Support

The insights derived from financial analytics are used to support strategic decision-making. Whether it’s determining pricing strategies, optimizing investments, or identifying cost-cutting opportunities, financial analytics provides the necessary data-driven evidence to make informed decisions.

8. Reporting and Visualization

Finally, financial analytics involves creating detailed reports and visualizations to communicate findings to stakeholders. Advanced visualization tools help in presenting complex data in a clear and comprehensible manner, making it easier for decision-makers to understand and act upon the insights.

By leveraging these steps, Quantzig utilises financial analytics to help organizations improve financial performance, manage risks, and drive sustainable growth.

Experience the advantages firsthand by testing a customized complimentary pilot designed to address your specific requirements. Pilot studies are non-committal in nature.

Request a free pilotImportance of Financial Analytics

Financial analytics is essential for businesses because it provides a data-driven approach to decision-making. By analyzing financial data, businesses can identify areas of inefficiency, optimize financial performance, and make informed decisions about investments and resource allocation. Here are some of the key benefits of financial analytics:

- Improved Decision-Making: Financial analytics provides a data-driven approach to decision-making, allowing businesses to make informed decisions based on facts rather than intuition.

- Enhanced Risk Management: Financial analytics can help businesses identify and mitigate risks by analyzing financial data and identifying potential areas of vulnerability.

- Increased Efficiency: Financial analytics can help businesses optimize financial performance by identifying areas of inefficiency and implementing cost-saving measures.

- Better Forecasting: Financial analytics can help businesses improve their forecasting abilities by analyzing historical financial data and identifying trends and patterns.

- Competitive Advantage: Businesses that use financial analytics can gain a competitive advantage by making more informed decisions and identifying opportunities that their competitors may miss.

Financial analytics is crucial for businesses as it enables a data-driven approach to decision-making, allowing companies to identify inefficiencies, optimize performance, and make informed investment and resource allocation choices. Key benefits include improved decision-making based on factual data, enhanced risk management through the identification and mitigation of vulnerabilities, increased efficiency via cost-saving measures, better forecasting by analyzing historical data and trends, and gaining a competitive advantage by identifying opportunities overlooked by competitors. Quantzig can assist businesses in implementing financial analytics by providing expert data analysis, developing tailored analytics solutions, and offering actionable insights to optimize financial performance, mitigate risks, and drive strategic growth.

Benefits of Financial Information Analysis

Finance Performance & Analytics offer numerous benefits, including enhanced financial planning and budgeting, improved decision-making, effective risk management, performance measurement and tracking, and increased profitability and growth. Data-driven insights within financial analytics benefits enable more accurate financial planning and budgeting processes by creating an ai driven financial analysis and realistic forecasts based on historical data and current trends.

- Enhanced Financial Planning and Budgeting: Data-driven insights lead to more accurate financial planning and budgeting processes. We assist in creating realistic forecasts based on historical data and current trends.

- Improved Decision-Making: With a clearer understanding of financial health, finance teams can make more informed decisions regarding resource allocation, investments, pricing strategies, and cost-cutting measures.

- Risk Management: FPM Analytics helps identify potential financial risks early, allowing proactive steps to mitigate them.

- Performance Measurement and Tracking: It facilitates tracking key performance indicators (KPIs) to measure progress towards financial goals and objectives.

- Increased Profitability and Growth: By optimizing financial performance through better decision-making, FPM Analytics can drive increased profitability and sustainable growth for the organization.

Applications of Data Analytics and Finance

Financial analytics has a wide range of applications across various industries. Here are some AI & Advanced Analytics examples where Quantzig helps businesses:

- Portfolio Management: Financial analytics can be used to analyze and optimize investment portfolios, ensuring that they align with an organization’s financial goals.

- Risk Management: Financial analytics can be used to identify and mitigate risks, such as credit risk, market risk, and operational risk.

- Financial Planning and Budgeting: Financial analytics can be used to create financial plans and budgets that are tailored to an organization’s specific needs and goals.

- Performance Measurement: Financial analytics can be used to measure and evaluate financial performance, identifying areas of strength and weakness.

- Compliance and Regulatory Reporting: Financial analytics can be used to ensure compliance with regulatory requirements and to prepare financial reports.

Financial analytics provides substantial benefits across various industries, including portfolio management, risk management, financial planning and budgeting, performance measurement, and compliance with regulatory requirements. By using financial analytics, organizations can optimize investment strategies to align with financial goals, proactively mitigate credit, market, and operational risks, create precise and goal-oriented financial plans and budgets, evaluate financial performance to identify strengths and weaknesses, and ensure efficient compliance with regulatory standards. As experts in financial analytics, Quantzig offers comprehensive data analysis, advanced modeling techniques, and customized analytical solutions. Our expertise enables organizations to harness the full potential of their financial data, driving informed decision-making and enhancing overall financial performance.

Get started with your complimentary trial today and delve into our platform without any obligations. Explore our wide range of customized, consumption driven analytical solutions services built across the analytical maturity levels.

Start your free trialThe playbook for Financial analysis and performance involves –

Real-time insights powered by machine-learning algorithms are revolutionizing finance operations. By analyzing market trends and integrating data from various sources, organizations can achieve greater efficiencies and make informed decisions. Business intelligence tools, combined with enterprise performance management systems, enable seamless data integration and the creation of financial dashboards that provide real-time information. These dashboards utilize descriptive analytics to summarize historical data, diagnostic analytics to identify the causes of financial outcomes, and prescriptive analytics to recommend future actions. Leveraging the expertise of data scientists, companies can transform their financial operations, driving better performance and strategic growth. The playbook formula contains:

- Defining Goals and Objectives

- Understanding the business, technology & data landscape

- Identify Data Sources and Requirements

- Selecting right tool, tech and consumption models

- Developing business critical and relevant KPIs

- Leveraging financial analysis techniques such as Trend, variance, cost modelling, valuation, scenario modelling etc.

- Developing data assets and advanced analytics & Decision support solutions.

Way Ahead for Financial Analytics

Organizations rely on real-time insights derived from machine-learning algorithms to adapt to changing market trends swiftly. By optimizing finance operations through advanced analytics, businesses can streamline processes and uncover new efficiencies. Business intelligence platforms facilitate the integration of data, allowing for comprehensive analysis and informed decision-making. With enterprise performance management tools, companies gain actionable insights into their financial performance, enabling strategic planning and execution. Data integration ensures that financial dashboards provide up-to-date information, supported by descriptive analytics to summarize historical data, diagnostic analytics to pinpoint areas of improvement, and prescriptive analytics to guide future strategies. Through collaboration with skilled data scientists, organizations unlock the full potential of their data, driving innovation and growth.

Financial analytics is a powerful tool that can help businesses make more informed decisions, optimize financial performance, and gain a competitive advantage. By analyzing financial data and identifying trends, patterns, and correlations, businesses can gain valuable insights that can inform strategic decisions and drive success. Whether you are a financial professional or a business leader, understanding the importance and applications of financial analytics is essential for driving business success in today’s data-driven world.